Welcome to this week’s Market’s Compass Rising Market’s State ETF Review, Week #397, that is becoming revealed in our Substack Website. It will emphasize the specialized alterations of the 22 EM Country ETFs that we keep track of on a weekly basis and publish each and every 3rd week. Compensated subscribers will continue on to receive the Weekly ETF Research sent specifically to their registered electronic mail. Past publications also can be accessed by subscribers via The Market’s Compass Substack Blog. Following 7 days we will be publishing the The Market’s Compass US Index and Sector ETF Review.

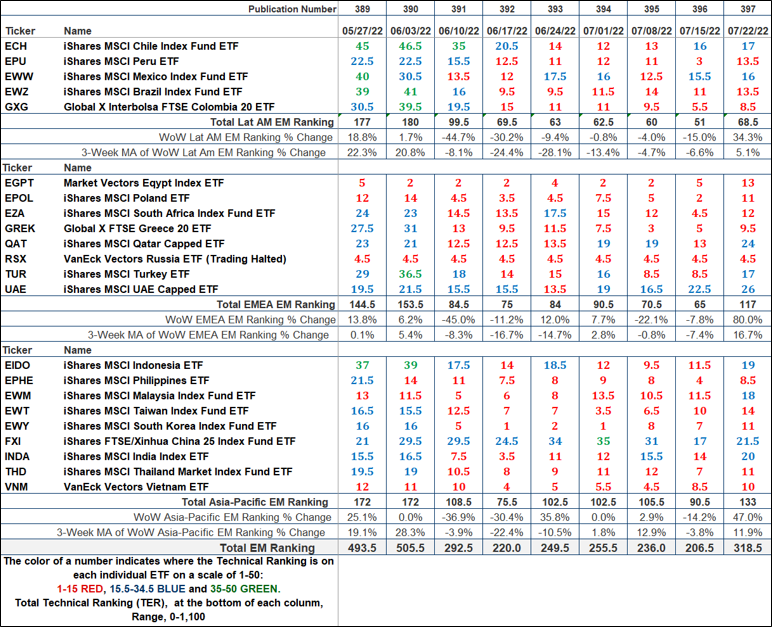

Last Week’s and 8 7 days Trailing Complex Rankings of the Person EM ETFs

The Excel spreadsheet down below indicates the weekly adjust in the Complex Rating (“TR”) of every unique ETF. The technological rating or scoring process is an entirely quantitative solution that utilizes various technological criteria that include things like but are not confined to trend, momentum, measurements of accumulation/distribution and relative power. If an personal ETFs technical problem enhances the Technical Ranking TR rises and conversely if the technological situation carries on to deteriorate the TR falls. The TR of each and every particular person ETF ranges from to 50. The primary consider absent from this spread sheet must be the pattern of the person TRs both the continued enhancement or deterioration, as well as a alter in route. Secondarily, a really small rating can signal an oversold condition and conversely a continued really significant range can be considered as an overbought problem, but with owing warning, over bought disorders can carry on at apace and overbought securities that have exhibited incredible momentum can easily grow to be more overbought. A sustained craze alter desires to unfold in the TR for it to be actionable. The TR of every single specific ETF in each and every of the 3 geographic locations can also reveal comparative relative energy or weakness of the specialized affliction of the select ETFs in the identical area.

The largest acquire of the 3 EM region Total Rankings because we previous released on July 5th was the Asia-Pacific region. The Whole Asia-Pacific Position rose +22.9% to 133 from 102.5 a few weeks ago. That was adopted by the Full EMEA Rating which rose +22.6% to 133 from 102.5. The attain in the Whole EMEA Ranking is noteworthy in that the VanEck Vectors Russia ETF (RSX) that not been investing because early March and its person rating carries on to be static at 4.5 and has been a drag on the Complete EMEA Overall Position. The Lat-AM Overall Position adopted the other regional counterparts with a smaller attain of +8.7% soaring to 68.5 from 62.5.