Table of Contents

To study the information, you would believe the sky is falling.

Crypto corporations are freezing investor resources. Some others are submitting for individual bankruptcy. As the rate of bitcoin has crashed, so has the rest of the marketplace, causing a domino influence that has spread through considerably of the crypto ecosystem.

I have two fantastic items of news for you.

The initially is that buyers who have adopted our uncomplicated investing system — a steady-drip every month expenditure employing established-it-and-forget-it applications like Coinbase and Betterment – are doing just fine. These companies have stood the exam of time, which is why we endorse them.

The second is that long-term buyers in our program are even now beating the inventory market. The Blockchain Believers, as we phone ourselves, are beating the Non-Believers.

Rome was not designed in a working day, and terrific fortunes are not constructed right away. If you received into crypto investing during the very last year, it could have been stunning to see your fast wealth, then dizzying to see it vanish in a make a difference of weeks. Stay the program.

In my e book Blockchain for Anyone, I tell my own rags-to-riches-to-rags story of heading “all in” on the 1st massive bitcoin boom, then losing it all about the subsequent few months. I’m so happy I stayed the course, simply because in time it grew to become rags-to-riches all more than once again.

Now, in reality, I have a Zen angle about the current market. The reality that bitcoin has misplaced 2/3 its value in considerably less than a calendar year bothers me not at all, mainly because I’ve diversified (the good lesson that I hope my guide will educate you).

Of program, I am anxious for those initial-time investors who have missing great quantities of cash, but that’s why we constantly preach this easy prepare, through both great situations and undesirable:

- Obtain bitcoin, as well as a tiny amount of substantial-high-quality digital belongings

- Established them up on a regular-drip prepare, investing the exact same quantity every month

- Make them section of an total portfolio (stocks, bonds, up to 10% crypto)

- Think very long-phrase (5+ many years)

- Total guidelines right here.

This tactic seems foolish in the increase times, when crypto services are providing 120% fascination charges, 10x leverage, and free of charge tokens. But in the tricky periods, anyone wishes they had followed it. Continue to be the program.

Some of you will have to sell your crypto to stay afloat in the course of these lean occasions, and a lot of of you will swear it off entirely. In my see, a better solution is to study from your problems, sell what you will have to, then set the relaxation into this very long-term investing plan.

I not long ago showed you that our easy “Big Believers Portfolio” has even beat the crypto hedge fund marketplace, at a portion of the charge. The crypto hedgies themselves would do improved to just comply with this prepare, but then they could not cost their exorbitant charges.

The Blockchain Believers Program has just one disadvantage: it’s unexciting. But very good investing ordinarily is. (Warren Buffett, try to remember, created most of his dollars on insurance policies.) If you want to gamble, go to Vegas. If you want to build long-expression prosperity to share with the planet, keep the training course.

Mind Hacks for the Investor State of mind

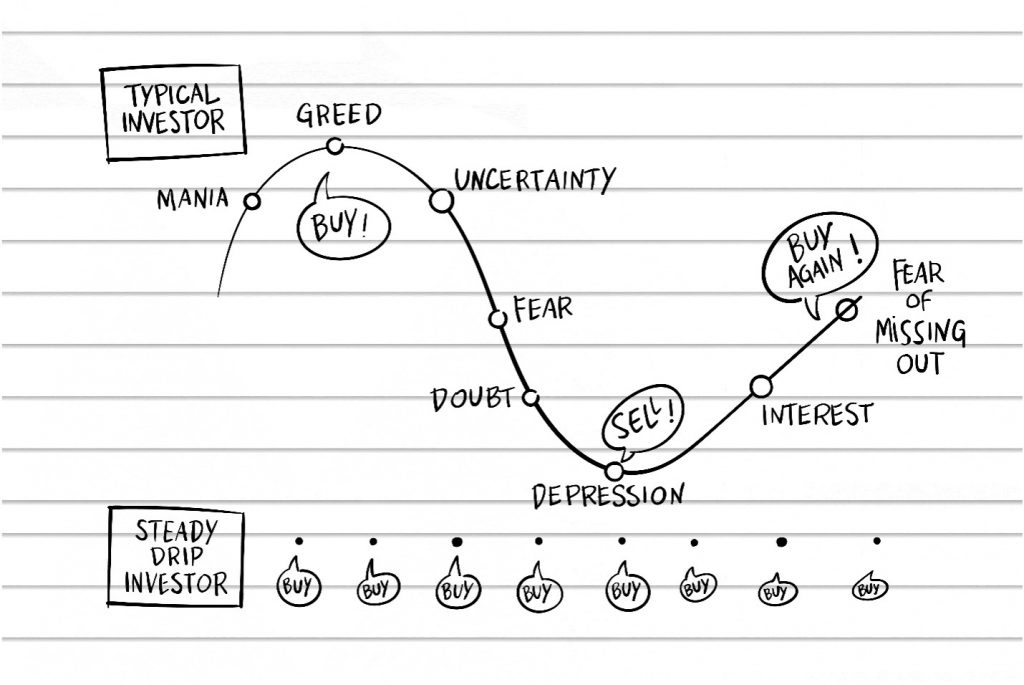

When the market place is down, it is difficult to think rationally. “Why obtain now, when the industry may go even reduce?” your brain will tell you. “I’m not heading to drop for that 1 once again.”

Listed here are a couple techniques you can use to preserve the Investor Mentality.

Think of crypto as computer software organizations. If bitcoin was a program firm, do you see it likely out of business whenever before long? Or is there sufficient need, and more than enough brand name, to have it through the rough instances? (Try to remember: tech businesses like Netflix and Amazon are being the program, and even ramping up choosing, all through this downturn.)

Imagine of crypto like dollars. We may possibly not like how cash markets are behaving, but handful of of us concern the validity of income by itself. If you consider of the transfer toward crypto as a ongoing action in the evolution of cash — from cash and paper, to ones and zeroes — that can make it less complicated to stay the study course. It is really challenging to see us heading back again to paper.

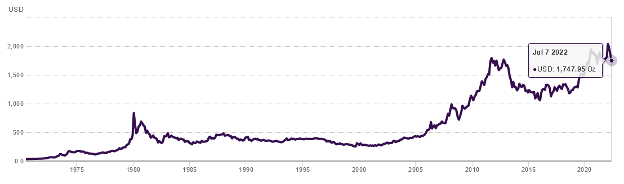

Think of crypto like gold. Consider of this time like the California Gold Hurry, all through which fortunes have been designed – both of those in gold mining, and in the “picks and shovels” – that changed the character of the United States. (The price tag of gold was set by the federal government till 1968: this chart is an argument for HODLing if at any time there was one.)

George Hearst: The OG Miner

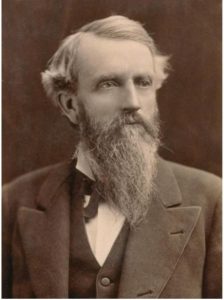

One of my favourite rags-to-riches tales is that of George Hearst, a miner who remaining a legacy.

Hearst grew up during the early 1800s on a little farm in Missouri, with tiny entry to formal training, but he did not allow that quit him. He cultivated an curiosity in mining, and started to instruct himself about gems and minerals, studying anything he could by browsing community mines.

After various yrs of mastering the mining small business, he read the news of gold in California (the crypto boom of its working day). He did his research, exploring to see if the rumors were true, then pulled with each other a social gathering of 16 prospectors to make the long, arduous journey to California, along with 1000’s of some others in search of fortune.

At 1st, they tried out Sutter’s Mill, wherever gold was initially learned, but they discovered it had been picked clear, and the enterprise pretty much didn’t make it by their initially winter season. Undaunted, they moved to a different website the next yr, but that also came up empty.

Hearst pivoted his mining technique from gold to quartz, drawing on his substantial awareness of minerals. He also diversified into prospecting (i.e., shopping for and leasing parcels of land that likely contained valuable mines). He opened a general retail outlet to sell the “picks and shovels.” He lifted livestock. These additional earnings streams assisted him experience out the rough situations.

It was practically ten decades before his endurance compensated off. He received a tip on a silver mine in existing-working day Nevada. Yet again, he did careful investigate to ensure the chance was a very good a person, then hurried down to acquire a 16% curiosity in the mine.

It was practically ten decades before his endurance compensated off. He received a tip on a silver mine in existing-working day Nevada. Yet again, he did careful investigate to ensure the chance was a very good a person, then hurried down to acquire a 16% curiosity in the mine.

That winter season, Hearst and his partners mined 38 tons of substantial-grade silver ore.

From there, he experienced ample money to repeat the formula, acquiring partnerships in substantial-opportunity mines, investing in the infrastructure to retain them successful and protected, and directing his newfound prosperity into enterprises to gain his shareholders and society.

The lessons we can acquire absent from the George Hearst tale are:

- Do your investigation find out all the things you can.

- Diversify your income streams, and your investments.

- Patience and persistence pay out off.

By examining this, you’re doing your investigation. By next the Blockchain Believers prepare, you are diversifying your investments. The remaining action is uncomplicated: just keep the class.

We’re in this for the lengthy haul. Get loaded slowly but surely. And throughout down situations, you may well even look at doubling down. The mine is completely ready and waiting around.