Table of Contents

Summary: I talk about the psychological game of investing, significantly as it applies to crypto markets. Subscribe below and observe me to get weekly updates.

Though crypto taxes can be complicated, the critical concepts are not. Take care of these concepts in your head:

These are taxable activities:

- Promoting crypto.

- Trading crypto.

- Acquiring stuff with crypto.

- Receiving crypto from airdrops, challenging forks, staking rewards, and the like.

These are not taxable occasions:

- Purchasing crypto.

- Donating crypto to a tax-exempt corporation.

- Gifting cryptocurrency (though large gifts may cause a present tax)

- Transferring crypto from 1 account to an additional.

This suggests your average DeFi degen is in for a earth of hurt this tax year: concerning all the buying and selling, staking, and generate farming, every transaction will need to have to be accounted for and described.

Be aware this is unique from how we take care of common currencies: you never have to report each monetary transaction to the IRS. That would be insanity: you just report summaries.

But most governments address crypto as residence, not cash, so every single time you swap tokens, it’s like you are selling properties or automobiles.

Crypto tax software attempts to convey purchase to this insanity by permitting you import all your transactions, then calculating your taxes. A single trouble: there is no common normal for formatting crypto transactions.

Crypto Tax Software program Needs a Universal File Structure

Many thanks to Bitcoin Industry Journal neighborhood member “Mr. X” who alerted me to this issue. “How about an report on how to spend in crypto without developing a tax nightmare?” he asked.

Mr. X’s predicament is widespread: last 12 months, he purchased and marketed crypto across several exchanges and wallets.

The trouble? Combining these transactions into his crypto tax program.

There are commonly two approaches of pulling your transactions: you join the tax application to your wallet through API, or you manually import a CSV file.

And you require to do this for each and every one system the place you have purchased or offered crypto.

Remain with me. This is important.

Let us say you obtain crypto on Binance, then transfer it about to Coinbase. Without equally information, it will glance like you offered it on Binance (which is a taxable party), instead than just moved it to yet another a single of your accounts (which is not).

All over again, there are two approaches of importing transactions into your crypto tax deal:

1) You can link your tax application through API to get an computerized obtain. Suitable away, this is also complicated for several consumers. (Elevate your hand if you know what an API is.) Also, APIs never usually work.

2) You can obtain a checklist of transactions from your crypto trade (e.g., Binance) or wallet (e.g., MetaMask). This listing of transactions is developed as a CSV file, which can theoretically be uploaded to your crypto tax software.

The difficulty is the details is not documented in a regular way.

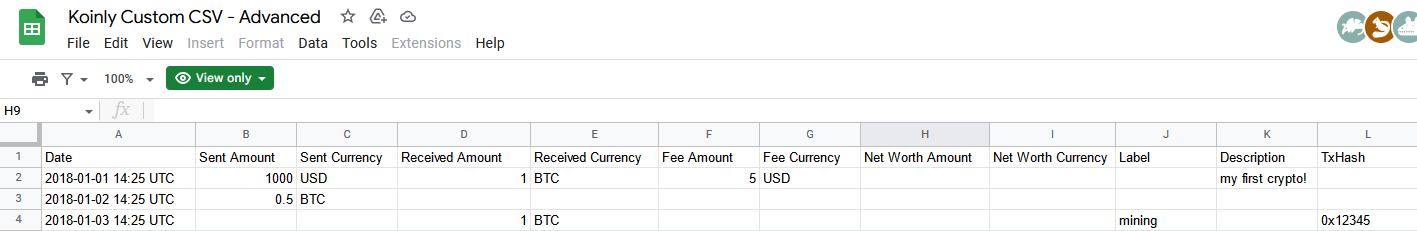

There is a Universal Structure for crypto tax CSV documents: see an case in point below. This is terrific if you have just completed a few transactions, but awful if you are a repeated trader, miner, loan provider, staker, or airdrop farmer.

Even worse, the facts that will come out of these platforms is nevertheless inconsistent, even if it’s in the proper structure. As an case in point of Mr. X’s nightmare, check out this badly-developed video from Cointracker:

https://www.youtube.com/enjoy?v=9eaOsXh2C04

Read through the responses to feel the agony of crypto buyers globally.

“I’ve very easily clocked in much more than two solid days of spreadsheet operate attempting to master how to do this properly,” Mr. X reported.

Translation:We want uniform tax reporting expectations.

Here’s a improved video clip from Koinly describing how to make CSV data files for crypto tax reporting, which seems about as fun as dental work:

https://www.youtube.com/enjoy?v=mnYy2NKIfAI

Go through the remarks to see the complexity of crypto tax worries.

Mr. X’s advice is for the marketplace to agree on a Common Structure for crypto tax reporting, 1 that will be applied by each wallet and exchange.

Such a tax reporting regular would in all probability want to be proposed by an worldwide specifications entire body.

As luck would have it, the Institute of Electronics and Electrical Engineers (IEEE), which is the worldwide standards-environment system for technology, has a blockchain doing work group. You can see a record of the requirements in development, but alas, no crypto tax reporting common … nonetheless.

I contact on the powers of the IEEE to give us tax reporting criteria that will export CSVs with steady time stamps and headers, all capturing equivalent info.

That is the long-term correct. The short-time period deal with is a little something you can do, appropriate now.

How to Minimize Your Tax Headache

In the meantime, right here are some recommendations to help lower the time put in reporting and filing taxes.

Remain on a single wallet or system. If you’re accomplishing every little thing in Coinbase, stick with Coinbase. If you swap in MetaMask, adhere with MetaMask. If you adhere with 1 reputable platform, they’ll build a summary you can give to an accountant or upload to TurboTax (no crypto tax software required).

Nonetheless, there are threats with this approach. If your crypto wallet or trade is hacked, you could reduce it all. There is no best answer here, but you could break up the variance: use just one wallet or exchange for holding, and a further for advertising or buying and selling.

Use platforms and wallets with API assistance. They should give you complete transaction background for all time, which includes deposits, withdrawals, and trades. (Many do not, as explained well in Cointracker’s great crypto tax guidebook.)

If you can get the API to function, this eradicates the headache of mucking about in CSV information. Recall that APIs are dynamic (actual-time feed), when CSVs are static (a snapshot in time).

Provide and trade as small as attainable. Recall: most governments handle crypto as home, so each sale and trade is a taxable function. That means you possibly have to spend taxes on the profits (funds gains), or can potentially assert the loss (funds losses).

But getting crypto is free of charge.

You don’t pay out tax on buys, which is why regular-drip investing is so potent: you can maintain investing in crypto as lengthy as you like, and only shell out taxes when you dollars out. Traders have to endure a tax nightmare extensive-phrase hodlers can rest nicely at night time.

In other phrases, KISS (Retain It Basic, Foolish).

- A acquire-and-maintain approach…

- With a month-to-month contribution…

- on a trusted wallet or exchange…

- can lower your tax prep to the bare least.

Cash out only when you are all set, pay taxes on the gains, and you’re accomplished.

Which is as easy as crypto taxes get.

50,000 crypto buyers get this column each and every Friday. Click here to subscribe and be a part of the tribe.