Table of Contents

Justin Sullivan/Getty Visuals News

Salesforce (NYSE:CRM) could not be the to start with name you’d believe of purchasing amidst the volatility in tech shares. Even immediately after the the latest selloff, the stock is not certainly cheap relative to other shares of a very similar expansion cohort. The organization has a extensive heritage of M&A in the tech sector with a thriving keep track of history of noticing functioning synergies. The inventory may possibly not be the fastest developing identify in tech, but it features a solid combination of progress and profitability which, alongside mature cash allocation procedures, can allow the stock to supply sturdy returns for extended expression buyers.

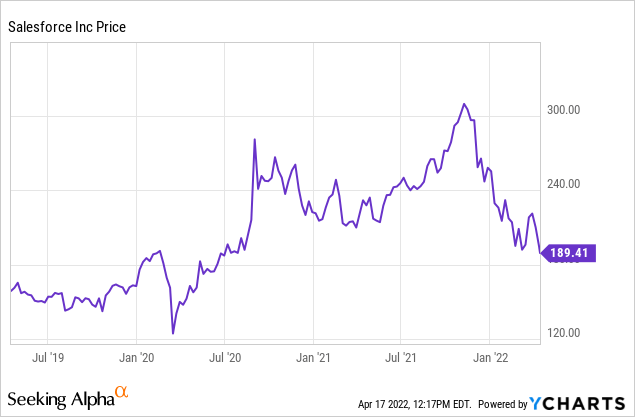

CRM Inventory Selling price

CRM peaked above $311 for each share but has due to the fact fallen down to all-around $189 for every share. The stock now trades with minimum returns about the past 3 yrs.

I past included the name in January when I named the inventory a buy in spite of the premium several (however pointed out far better opportunities elsewhere in the sector). Because then, tech has continued to crash and CRM has held up much better than substantial-progress friends. That observation may perhaps engage in an significant function in how CRM allocates capital shifting ahead.

The Salesforce Investment decision Thesis

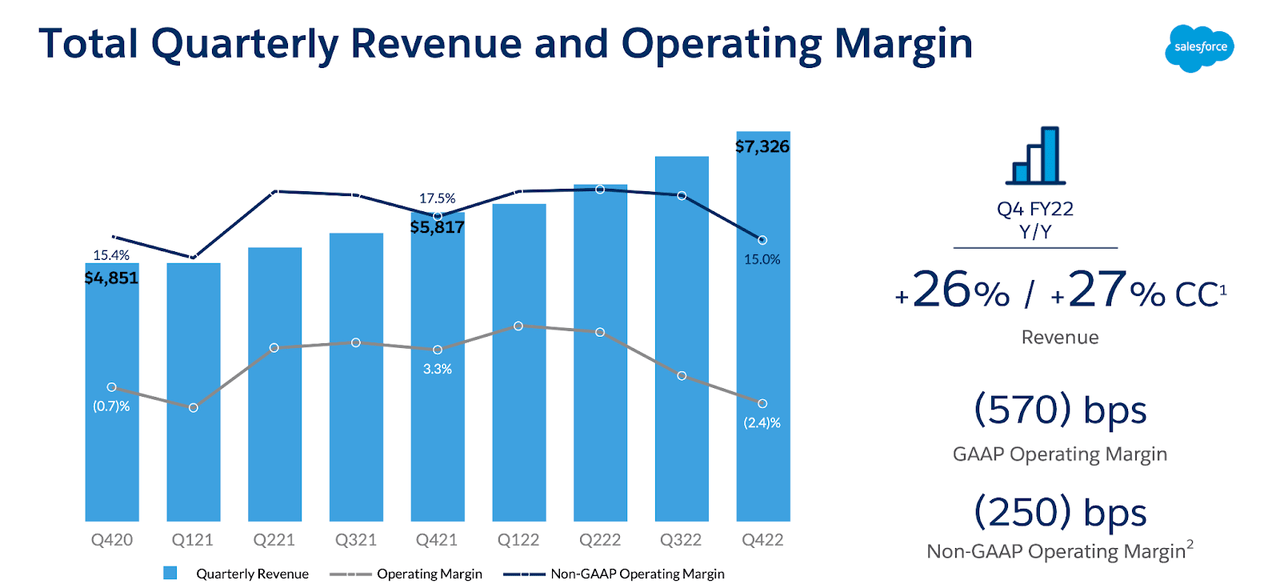

CRM closed out very last year with 26% revenue expansion in the fourth quarter although maintaining reliable 15% non-GAAP operating margins.

Salesforce FY22 Q4 Presentation

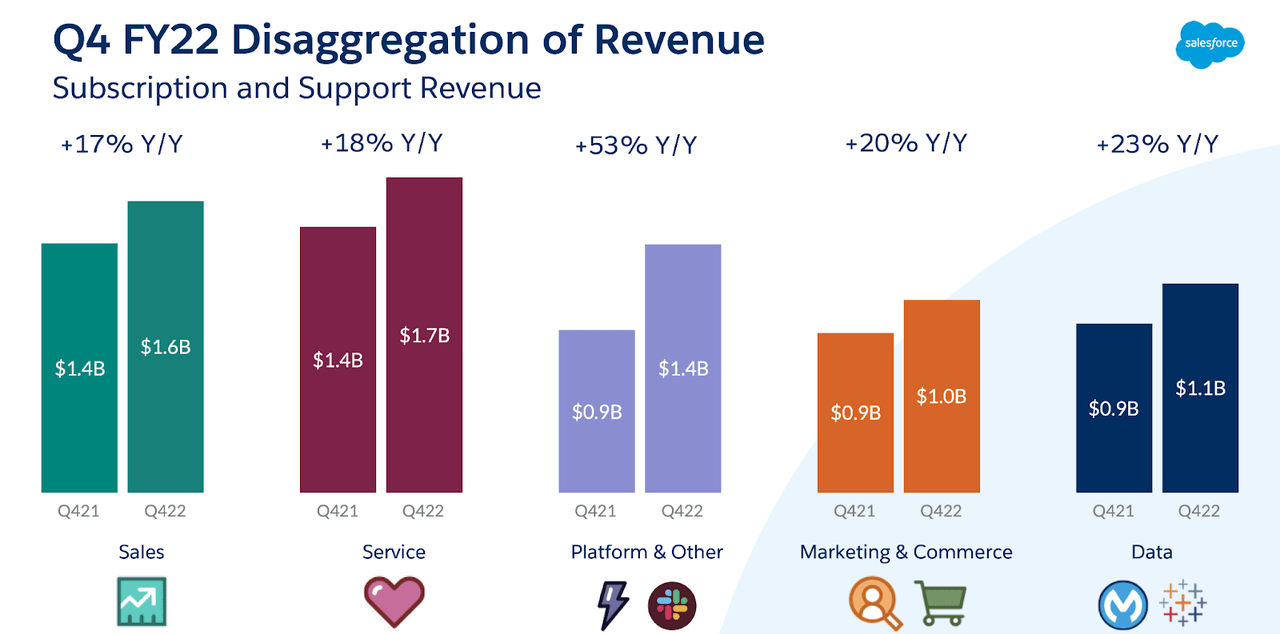

That development price is impressive looking at that the company generated 24% income development in 2020. In my view, the company has been ready to maintain higher than-market major line advancement largely owing to its intense external acquisition streak. We can see under that departments like by acquisitions like Slack and MuleSoft produced considerably of the development, supporting to offset the slowing advancement in the main CRM company.

Salesforce FY22 Q4 Presentation

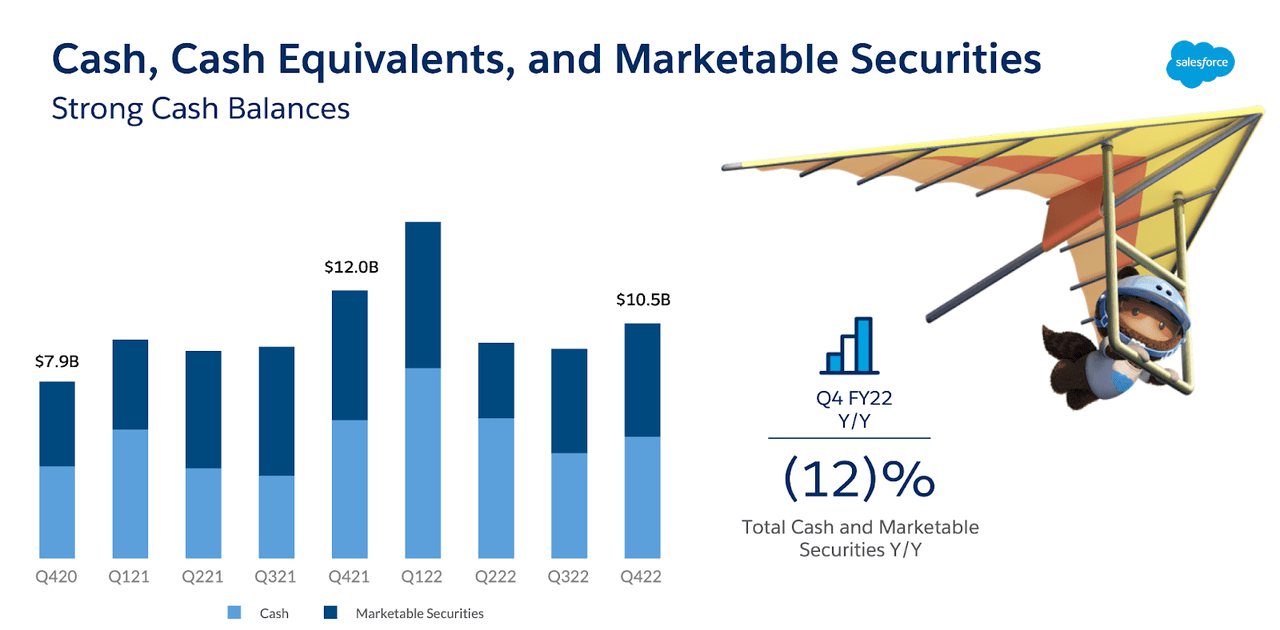

Prior to this tech crash, that variety of observation could make a worthy argument versus acquiring the stock, particularly thinking of that the stock has very long traded at curious valuations relative to its natural and organic advancement level. But with the tech sector crashing, this might be CRM’s chance. CRM ended the calendar year with $10.5 billion of cash & marketable securities, which does not include an additional $4.8 billion of strategic investments. As disclosed in the yearly filing, the strategic financial investment portfolio is made up of 400 firms, typically privately held.

Salesforce FY22 Q4 Presentation

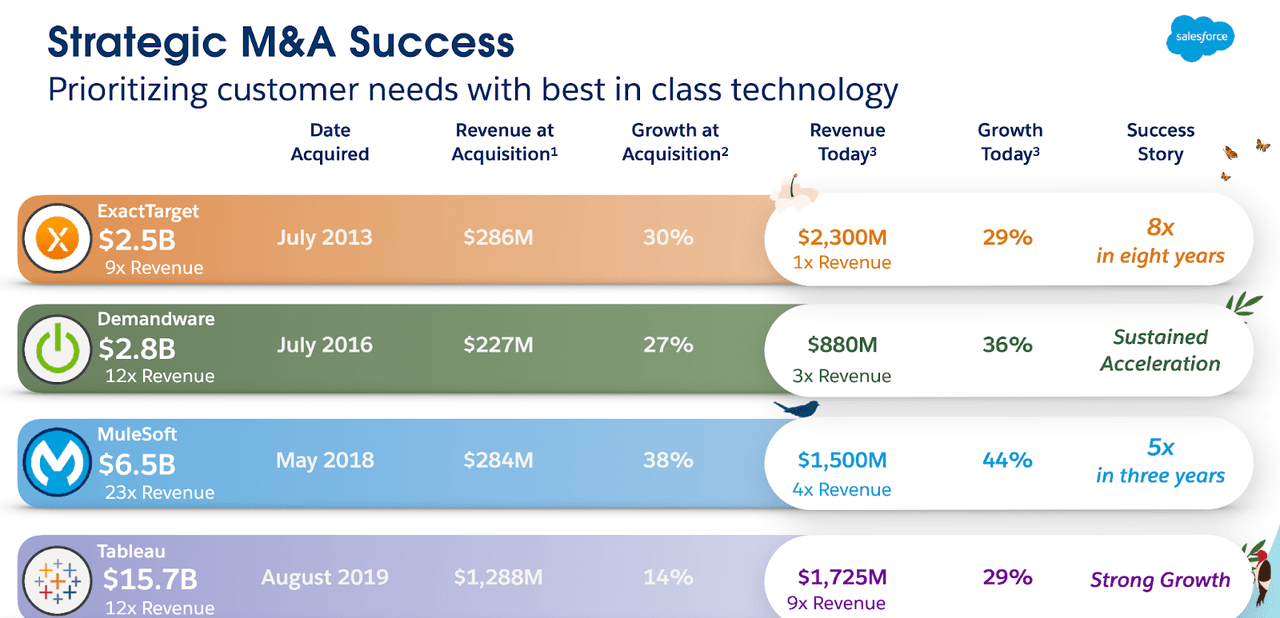

CRM does have $10.6 billion of lengthy term financial debt, this means that it does not have a substance internet money equilibrium sheet. Still this may well in fact be a constructive indication as it reveals management’s willingness to benefit from leverage – that is one thing that a lot of more youthful tech firms feel to have not however embraced. We could see below that CRM has an extraordinary observe record of determining M&A targets and sustaining higher development rates even a lot of decades after acquisition.

Salesforce FY22 Q4 Presentation

In the recent setting, CRM may be ready to take gain of reduced tech valuations by earning but one more massive acquisition.

Is CRM Stock A Obtain, Sell, or Keep?

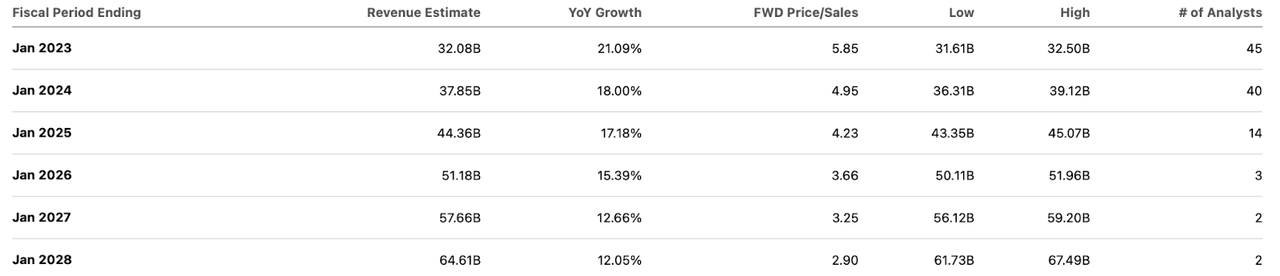

Company management experimented with to dispel any idea that they have M&A ideas on the convention contact, but I am skeptical that they are not actively considering these types of plans due to their observe document. Even without having the impact of M&A, the inventory trades moderately at 8x gross sales (I am applying 1 billion shares superb).

Seeking Alpha

The enterprise generates a meager 5% web margin, but my perspective pertaining to these tech stocks is that margins are generally understated owing to large financial investment in development. I could see CRM sooner or later reaching 30% internet margins more than the extensive expression after the business starts prioritizing revenue over high growth. The inventory is at this time trading at 27x earnings energy based mostly on that assumption. The firm has guided for 21% advancement this coming yr. Implementing a 2x price to earnings growth ratio (‘PEG ratio’), I could see CRM buying and selling at 12x revenue, symbolizing a inventory price of $284 or 50% upside. That explained, a 2x PEG ratio may not be correct in the existing ecosystem based on frustrated tech valuations and the simple fact that CRM is not developing as speedily as just before. If we as a substitute believe a 1.5x PEG ratio, then CRM could possibly trade at 9.5x product sales, symbolizing a inventory cost of $225 for every share or 19% upside. The key threat here is if I am confirmed mistaken about the understated financial gain margins primarily if this coincides with promptly decelerating progress charges. CRM is currently successful and therefore does not have economic solvency possibility, but the quality PEG ratio assigned to the stock may evaporate swiftly if Wall Street loses confidence in possibly the profits expansion fee or skill to travel working leverage. CRM is not as affordable as lots of other tech names of a equivalent expansion cohort but the stock’s stable profitability and probably to capitalize on M&A make the stock a obtain these days.