Table of Contents

Disclaimer

This report is intended for CoinSutra VIP users. This research report is based on the current market conditions and should not be treated as direct financial advice. Investing in crypto-assets has risk due to high volatility, so invest only that amount which you are ok to lose. We are not a financial advisor, and this is not a financial advice. #DYOR

The blockchain industry has come a long way in the last decade. With so many networks and applications at our disposal, this technology would disrupt several existing industries.

But as of now, there is a bottleneck. All the networks and applications in themselves are isolated from each other. Let’s take Uniswap as an Example.

Uniswap is a Decentralised Exchange (DEX) built on the Ethereum blockchain network. You can use this exchange to swap crypto tokens. But there is a problem that it’s built on the Ethereum network, and you can only swap Ethereum-based tokens. Non-Ethereum tokens need to be listed in a Synthetic or Derivative form, also known as Wrapped Tokens. So, platforms like Uniswap lack cross-chain functionality.

Now let’s take Binance as an example which provides users with a complete cross-chain experience. On Binance, you can very easily swap ETH with BTC. Both of these tokens pertain to different networks. But the biggest problem with Binance is that it is centralized and custodial. This is against the core values of the blockchain industry.

The majority of crypto transactions are still being processed through centralized exchanges such as Binance, Coinbase, FTX, etc. It is not a secret that these exchanges have full custody of your funds, and in case there is a hack on the exchange, you may lose all your funds. Further, with these exchanges handling such an enormous amount of trading volume, they would become the future banks of the industry with so much centralized power.

Therefore, there was a need for a solution. The ideal blockchain ecosystem is entirely decentralized and cross-chain. This means that no single platform or network would dominate the industry. Further, all the applications and assets are interoperable with each other.

Thorchain is a project that tries to do that. So let’s find out what this project is all about.

What is Thorchain?

For a layman, Thorchain can be described as a Cross-Chain Uniswap. But there is a lot more to it.

Thorchain is a Layer 1 blockchain network built with Cosmos SDK (Software Development Kit). Because of this, Thorchain is a network that is interoperable with other blockchain networks. Thorchain has a cross-chain liquidity model built on this network that allows you to:

- Swap crypto assets even if two assets pertain to different blockchain networks. For example, swapping ETH (Ethereum Network) with BTC (Bitcoin Network). Further, this swap is done in a decentralized and non-custodial manner.

- Earn passive income on your crypto assets by depositing them into Thorchain Liquidity Protocol.

Currently Supports the following assets as of April 2022:

Who are the Founders of Thorchain?

Thorchain was and is being built by an anonymous team of developers. Therefore, we don’t have the background details of any lead member.

Thorchain is more like a community project with no control or command structure. You can read more about this here.

Now let’s understand the possible use cases of the Thorchain Protocol.

What are the Use Cases of Thorchain?

The use cases of the Thorchain network are as follows:

1. Thorswap

Thorswap is a multi-chain DEX (Decentralised Exchange) built on the Thorchain network. It uses Thorchain’s Liquidity Protocol, where you can either swap tokens or provide liquidity.

For more information on this, you can read our Beginner’s Guide for Liquidity Pools.

2. Thorchain Name Service

Thorchain name service is a Domain Name Service similar to Ethereum Name Service. You can register a multichain domain name with Thorchain, which you can further use for sending and receiving funds. If a receiver has a Thorchain domain name, the sender would simply add the domain name in the transaction interface instead of a complicated wallet address.

This simplifies the process of sending and receiving crypto funds.

You can explore Thornames here.

3. Thorchain Synthetics

Thorchain Synthetics are a derivative version of Layer 1 crypto assets. For example, ETH is a cryptocurrency native to the Ethereum Network. sETH is a synthetic crypto-token issued on the Thorchain network which would mimic the value of ETH. The benefit of a synthetic asset is that you can trade sETH on Thorchain without paying a high gas fee of the Ethereum Network. Further, the transaction time would also be significantly less.

In the case of synthetics issued by Thorchain, assets are backed up by 50% of the asset whose synthetic version is created and 50% of RUNE tokens.

Projects like Synthetix and Mirror Protocol already provide similar synthetic tokens. You can read more about Mirror Protocol here.

Further, you can read more about Thorchain Synthetic Assets here.

4. Digital Collectibles

Like any other Layer 1 blockchain network, Non-Fungible Tokens can be created on Thorchain. Currently, there are several collections generated on the network, such as Thorchain Collectibles, THORGuards, PixelTHOR, ThorchainPunks, ROON, etc.

If you are new to the concept of NFTs, then you can refer to our Beginner’s Guide to NFTs.

How does a Swap transaction work in Thorchain?

Let’s assume that you want to swap 1 BTC with ETH. In other words, you are selling BTC and buying ETH. There would be three different transactions.

- BTC is sent from your wallet to Thorchain Vault,

- ETH is sent from the Thorchain vault to your wallet, and

- RUNE in the ETH+RUNE liquidity pool is transferred to the BTC+RUNE liquidity pool.

You can read more about Thorchain Swap transaction here.

Now on this transaction, the following cost will be incurred by the protocol:

- Inbound transaction gas fee

Gas fee for transfer of BTC from your wallet to Thorchain Vault. Gas fee would be paid in BTC. Let’s assume the gas fee to be $100.

- Outbound transaction gas fee

Gas fee for transfer of ETH from Thorchain Vault to ETH – Gas fee paid in ETH. Let’s assume the gas fee to be $100.

- Slippage cost

Slippage is the cost of change in asset liquidity. You can read more about slippage here. Let’s assume the slippage fee to be $100.

The fee collected from you for this swap would be as follows:

| Particulars | Amount (Estimate) |

| Inbound Gas Fee | $100 |

| 3 Times Outbound Gas Fee | $300 |

| Slippage Fee | $100 |

| Total Fee | $500 |

You can read more about the fee charged by Thorchain here.

Note: The above transaction cost is just an example to explain the mechanism. Depending on the network traffic, the actual gas cost may be high or low.

What are the Components of Thorchain?

The main components of Thorchain are as follows:

1. Parties Involved

The three types of people involved in the Thorchain ecosystem are:

- Traders

- Liquidity Providers

- Node Operators

A Trader is a person who would use the platform for swapping crypto assets. For using the Thorchain swapping service, the trader would pay a Trading Fee which is the primary revenue source of the platform.

These users deposit their assets in the Liquidity Pools and earn yield. This yield is paid by the protocol from the fee collected from the traders. 33% of the protocol’s revenue is distributed to Liquidity providers.

These are people who run nodes on the Thorchain known as Thornodes. Further, these operators also run a node on each supported chain such as Ethereum, Bitcoin, Terra Network, etc. 67% of the protocol’s revenue is distributed to Liquidity providers. Private Keys of assets help in the Liquidity Pools is kept with node operators in a decentralized manner. To successfully process a transaction, 2/3rd of nodes need to confirm it.

2. Thorchain Network Nodes

As already stated, Thorchain is a network built on computer nodes. These nodes are also known as Thornodes. The current number of active nodes is around 100, which is expected to be extended to 250 in the long run.

These node operators are responsible for an efficient transaction throughput of the network. All the Thornodes are anonymous and do not support public delegation.

Further, all the private keys are stored with these nodes in a decentralized manner. Any transaction would need the approval of atleast 2/3rd of the Nodes.

Thorchain network nodes must lock RUNE tokens into the protocol as collateral. The amount of RUNE tokens to be locked would be equivalent to the Total Value of assets locked on Thorchain.

Further, if any node operator misbehaves, then his share of collateral could be slashed. Thus, keeping the nodes in check.

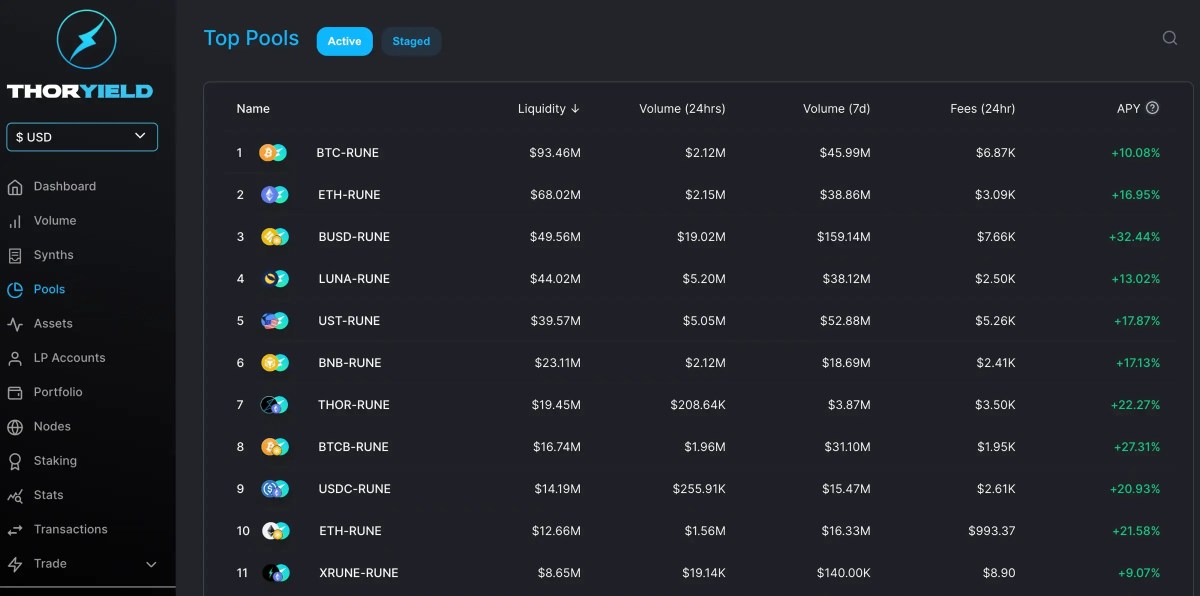

3. Thorchain Liquidity Pools

Liquidity Pools are the most important component of the Thorchain ecosystem as the whole ecosystem is built around these pools.

These are dual asset pools in which one asset would always be RUNE which is the in-house token of the platform. In other words, if there is an ETH pool, then the pool would consist of ETH and RUNE in a 1:1 ratio of value. Similarly, if there is a BTC pool, then the pool would consist of BTC and RUNE in a 1:1 ratio of value.

As already mentioned, 33% of the platform’s revenue would be distributed to the Liquidity Providers of these pools.

While depositing funds into a liquidity pool, liquidity providers would only pay the normal gas fee (a.k.a. Inbound fee). However, the outbound fee is three times the average gas fee while withdrawing these assets.

Further, Thorchain also provides Impermanent Loss Protection to its Liquidity Providers. In case there is an Impermanent loss to a Liquidity Provider, then this loss is compensated by the protocol in the form of RUNE tokens. However, Impermanent loss protection is partial for the first 99 Days of providing liquidity. After that you kept complete protection.

You can learn more about Impermanent Loss with our Beginner’s Guide.

4. Thorchain Vaults

The total assets of the protocol, i.e., pool assets, nodes bonded assets, and other assets, are kept in two different types of vaults.

- Inbound Vaults, a.k.a. Asgard TSS Vaults

These vaults hold most of the assets of the protocol. Any transaction through these vaults needs atleast to be approved by atleast 2/3rd of the nodes. Therefore, the transaction is super secure, but it’s also slow.

The second type of vault is called outbound vaults.

- Outbound Vaults, a.k.a. Yggdrasil Vaults

These are the vaults handled by individual node operators. Any transaction from this vault only needs that respective node operator’s signature. Therefore, the transaction is faster, but it is less safe. From the security point of view, the value of assets in an Outbound Vault would never be more than 25% of the collateral provided by the node operator. This way node operator would not have any motivation to steal the funds.

You can read more about Thorchain Vaults here.

5. RUNE Token

RUNE is the in-house token of the Thorchain ecosystem, which also acts as its backbone.

Token Economy of RUNE

| Particulars | Amount |

| Maximum Supply (Source) | 500 Million |

| Total Supply | 335 Million |

| Circulating Supply | 330.7 Million(66% of the Maximum Supply) |

| Token Price (as of 13 May 2022) ($) | $ 3.58 |

| Market Cap ($) | $ 1.18 Billion |

| 24 Hour Trading Volume ($) | $ 218 Million |

| Total Value Locked ($) | $ 225 Million |

Initially, RUNE had a maximum supply of 1 Billion. However, in October 2019, this supply was reduced to 50%, i.e., to 500 Million. The initial supply of 1 Billion was minted, and later on, the part of tokens lying unused in Reserves was burnt to reduce the maximum supply. You can read more about RUNE token burn here,

The total supply is 335 Million, and the circulating supply is 330.7 Million which is 66% of the maximum supply.

As of 13 May 2022, the token price is $3.58, which makes the market cap around $1.18 Billion. Further, the platform has a Total Value Locked (TVL) of $225 Million.

Token Distribution

| Particulars | %age | No. of Tokens |

| Seed | 5% | 25 Million |

| Initial DEX Offering (IDO) | 16% | 80 Million |

| Developers | 10% | 50 Million |

| Operational Reserve (Company) | 13% | 65 Million |

| Community Reserve | 12% | 60 Million |

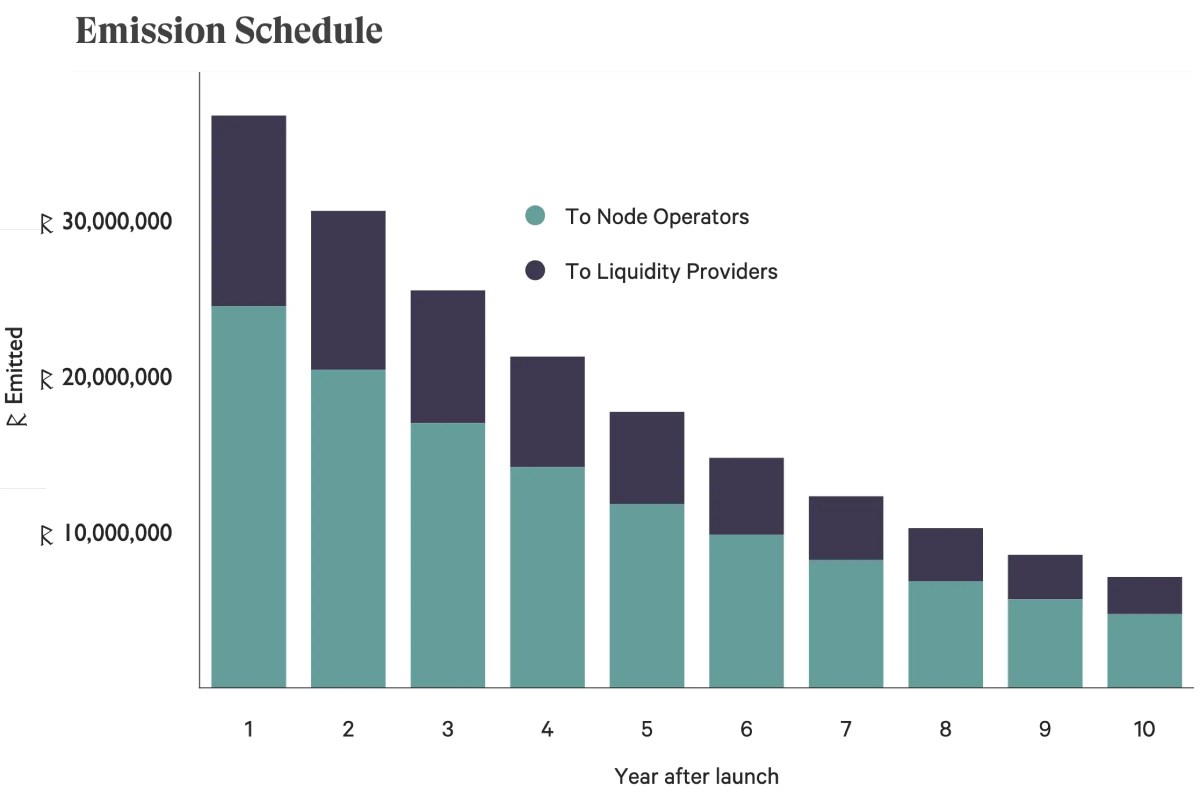

| Nodes and LP Rewards (10+ Years) | 44% | 220 Million |

| Total | 500 Million |

Token Emission

The remaining RUNE tokens are expected to be emit till 2028 in the following manner.

Further, RUNE incentives would be distributed to Node Operators and Liquidity Providers something like this.

Use Cases of RUNE token

The use cases of RUNE tokens are as follows:

- Fees charged by the traders are collected in RUNE.

- The RUNE holders govern Thorchain.

- ThorNodes need to bond RUNE tokens to validate a transaction.

- Each liquidity pool has a 50% share of RUNE tokens. This means that if you want to deposit ETH in the Thorchain liquidity pool, you need to deposit an equal amount of RUNE tokens.

In other words, RUNE provides a four-dimensional utility to the protocol:

| Liquidity All the liquidity pools in the protocols have 50% RUNE in them. |

Security All the node operators need to bond RUNE Tokens as collateral. This collateral can be slashed upon any misbehavior from the node operator. |

| Governance RUNE holders can participate in the governance of the protocol. |

Incentives Incentives to Liquidity providers, node operators, and traders are paid in RUNE. |

Where can you buy RUNE Token?

You can buy RUNE tokens on the following crypto exchanges:

| Centralized Exchanges | Remarks |

| Binance | Available for all parts of the world except the US and sanctioned countries. US Residents should use Binance.US |

| ByBit | Not available in the US and Singapore. |

| FTX | Not available in the US |

| MEXC Global | Not available in the US |

| Decentralized Exchanges | Remarks |

| Binance DEX | Gas fee will be charged in addition to the trading fee. |

| Thorswap | Gas fee will be charged in addition to the trading fee. |

Where can you buy RUNE Token?

Wallets, where you can keep your RUNE tokens safely are as follows:

For more information on Crypto wallets, you can refer our Crypto Wallet Guides as follows:

Thorchain Network Statistics

Total Value Locked as of 30 April 2022

What is the Revenue Model of Thorchain?

Thorchain has the following sources of income and corresponding expenses:

| Income | Expenses |

| Token Swap Fee | Block Rewards (67% Nodes, 33% LPs) |

| Thorname Registration Fee | Impermanent Loss Protection |

| Synth Minting Fee | Synth Staking Yields |

| Node Slashing Penalties | Any other rewards |

| Network fee for on-chain transactions |

Roadmap of Thorchain

In the coming future, Thorchain will be working on features such as:

- Market orders

- Limit Orders

- Leverage Trading

- P2P (Peer to Peer) Lending

- Staking

- More network integrations (including privacy and layer 2 chains)

- More DEX (Decentralised Exchanges) integrations

- Lending and Savings

Thus, aiming to build a complete decentralized alternative ecosystem to centralized exchanges. You can read more about Thorchain Roadmap here.

Now, let’s consolidate the pros and cons of the project.

Benefits and Limitations of Thorchain

What are the Benefits of Thorchain?

The various benefits of the Thorchain protocol are as follows:

- Cross-chain ecosystem

Thorchain has substantially simplified the cross-chain operations. You can very easily swap one asset with another irrespective of whether the two assets pertain to a single blockchain network or not.

This would also give a boost to the cross-chain DeFi ecosystem.

- Decentralized and Anonymous

The complete process of swapping funds on Thorchain is decentralized and non-custodial. Further, user identity remains completely anonymous as there is no need for KYC. Therefore, any Decentralised Exchange (DEX) that wants to offer cross-chain services can simply source liquidity from Thorchain.

- Bug Bounties

Thorchain has a Bug Bounty program where anyone who would help identify the possible vulnerability in the protocol would be rewarded. The maximum bounty is $500,000.

You can read more about Thorchain bug bounty here.

- Security Audits

In the recent few months, Thorchain has been through several security audits. However, this was done after $8 Million were hacked and stolen from the protocol in July 2021. You can read more about the Thorchain Hack and Security Audit here.

Now, let’s see what the possible downsides of this project are.

What are the limitations of the Thorchain?

The various limitations of the Thorchain protocol are as follows:

- High transaction fee

As described in the example above, Thorchain charges a high transaction fee.

However, currently, there is a proposal to change the structure of outbound fees, which could reduce the burden on Traders and Liquidity Providers. You can find the said proposal here.

- Low Total Value Locked

Considering the cross-chain ecosystem offered by Thorchain, the current TVL of the platform is really low. The project would need to add more features and lower the transaction fee for better adoption of the platform.

- Centralization

With 100 active node operators, the network is a bit centralized at the moment. This is more or less an issue with every project built with Cosmos SDK. Practically, increasing the number of nodes would increase the time taken per transaction, making the network inefficient. So, this might not change in the future as well.

Conclusion – Thorchain Fundamental Analysis

Thorchain is one of the most significant cross-chain liquidity projects in the market. Conceptually the protocol has a mote in the market, and not many projects provide complete interoperability across various blockchain networks.

Further, people’s belief in the centralized crypto ecosystem is shaking because it risks an individual’s investment. Therefore, in the future, DeFi will be a primary crypto market and thus, the need for these projects will be on the rise.

Hence, RUNE is an excellent token to hold for the long term. Further, RUNE price movement is range-bound for a few months. Therefore, running a Grid Trading Bot could be a profitable avenue.

Resources

Kalki is a seasoned content writer with over two years of experience writing about blockchain and Cryptocurrencies. His passion for Bitcoin and cryptocurrencies bloomed in late 2019. Crypto’s technological and economic implications are what interest him most.

He is a Chartered Accountant and Lawyer with over 10 years of experience in the FinTech industry. He likes to read, travel and go for long rides on his bullet bike.