Table of Contents

Summary: I discuss about the mental match of investing, particularly as it applies to crypto marketplaces. Subscribe right here and abide by me to get weekly updates.

Warren Buffett famously mentioned, “When the tide goes out, you can see who’s been swimming naked.”

We’re starting off to see the skinny dippers.

The “Triple-S” bomb of Silvergate, Signature, and Silicon Valley Lender are now joined by Credit Suisse.

I suspect there will be a lot more to follow.

Appear: financial crises don’t take place right away. The Terrific Recession, for example, commenced in 2007 and ended in 2009 (or even 2014, dependent on how you evaluate it). It took 9 months from the collapse of Bear Stearns to the collapse of Basic Motors.

I not too long ago reminded you: do not panic. But also be aware that this economic disaster is not about: I predict it is only commencing.

In fact, I forecast it is the Starting of the Finish.

The Finish of Greenback Domination

The U.S. occupies a exclusive place in the world-wide economy: we keep the world’s reserve forex.

The dollar dominates, since the greenback denominates.

Most people accepts U.S. dollars. Anyone would like U.S. dollars. This gives the U.S. many positive aspects, these as reduced exchange price hazard and greater obtaining ability.

But this won’t past eternally.

Historically, one particular place has held the dominant reserve forex for about 100 a long time (give or take 20 yrs). Though the U.S. was formally declared the reserve forex immediately after World War II, it was informally employed as the reserve currency due to the fact the 1920s.

That is 100 several years.

Once again, these issues really don’t occur right away. It’s a sluggish-moving transition that is clear only after a couple many years have passed. But I believe the days of the U.S. dollar as the world’s reserve currency are coming to an conclude.

This shouldn’t be lead to for concern or alarm, simply because we’re resilient. We’ll tiptoe by way of these troubled instances, and we’ll arise stronger as a outcome.

What’s a lot more, I consider we can do greater.

The beneficial element of keeping the earth reserve forex is that the U.S. has been capable to enable deliver stability and confidence in the money procedure.

The destructive aspect is that it concentrates electric power and affect in the U.S., in some cases at the expenditure of scaled-down and weaker nations.

What’s more, when the U.S. money program appears shaky — as it has the past several days — it leads to reverberations all through the globe.

I believe we’ll seem again on the times of reserve currencies as a type of “financial colonialism,” wherever a person country had outsized electric power to work out its will on smaller sized, weaker nations. I suspect we will be ashamed of this time period of U.S. record we might even consider to make reparations.

But that day is in all probability considerably in the long run.

Of a person issue we can be guaranteed: the times of the U.S. dollar’s dominance will ultimately occur to an finish. Record exhibits us it’s not a dilemma of if, but when.

When the U.S. greenback is dethroned, then, what will exchange it?

A World-wide Electronic Forex

The excellent economist John Maynard Keynes was deeply involved in the Bretton Woods Convention, which sorted out the money mess adhering to Planet War II. 1 of his proposals was a new supra-countrywide forex referred to as the Bancor.

His proposal was in the end rejected in favor of a procedure of exchange costs pegged to gold, but due to the fact the U.S. held significantly of the gold, the greenback grew to become the de facto reserve currency.

(Here’s the entertaining World Income episode on this story, which requires employed stomach dancers and “copious quantities of alcoholic beverages.”)

Even though it unsuccessful at Bretton Woods, Keynes’ program of a “global currency” was revived following the 2008 financial disaster. It ushers in solid inner thoughts, particularly in the nation that would eliminate its reserve currency position.

It is time to revisit this idea at the time once more. Mainly because now we have a thing new to deliver to the desk: blockchain technology.

For various a long time, I’ve been portray the vision of a worldwide digital forex, designed on blockchain rails. Consider of it as the Blockchain Bancor.

Due to the fact the start of bitcoin, we’ve been planning for this second, stress-testing the tech, setting up the new payment rails. We’re however not prepared for primary time, but I predict this new period of fiscal uncertainty we are getting into will turbocharge the industry’s advancement and development.

To be clear, bitcoin will not grow to be the world’s reserve currency. Even though we connect with it a cryptocurrency, it’s not a forex. It does not keep its value. You cannot buy considerably with it. It’s additional like a technologies inventory than nearly anything else.

They’re all tech stocks. The overall cryptocurrency room is like investing in early-stage tech ventures.

That stated, they are quite exclusive tech stocks. These are providers building the foreseeable future of our world wide economic process.

That’s why this motion is world, not just primarily based in the U.S. We’re all investing in our foreseeable future dollars procedure — and if we do it proper, we all will reward.

Get All set for a Wild Journey

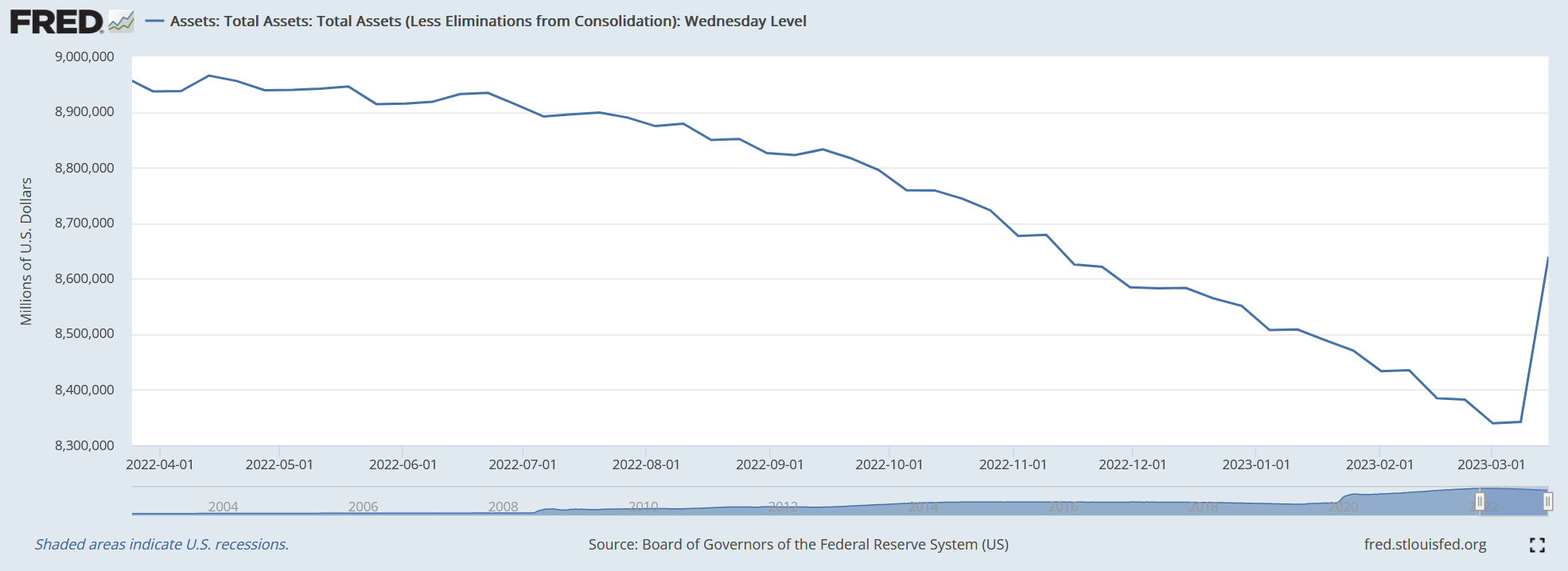

The U.S. Federal Reserve is now making an attempt to stability obtaining belongings (i.e., giving liquidity to failing banking institutions) while at the same time raising desire costs (i.e., battling inflation).

This could ultimately direct to a devaluation of the U.S. greenback, which could have unfavorable results on the international economic climate, as investors eliminate self esteem in the greenback and shift their investments in other places.

Currently, this seems to be going on with a flight to bitcoin.

In the 1970s, for illustration, the Fed pursued a coverage of both expanding the money provide and boosting interest costs, which resulted in stagflation, the place the financial state was stagnant although inflation continued to increase.

All over again, this could lead to a flight towards bitcoin and electronic property.

Visualize that we’re in the early phases of a prolonged economic disaster, a thing like the 2007-2009 time time period. Extra financial institutions are unsuccessful, and a lot more people today begin to notice the almighty U.S. greenback is not all-mighty.

Where by will people today change?

Below we have great proof from other international locations that have endured financial instability about the very last ten years: the citizens convert to bitcoin.

As extra people today rush into bitcoin, this will drive the value up. Men and women will rapidly recognize, on the other hand, that bitcoin is no safe haven: in simple fact, as rates rise, they will consider how a great deal superior it is than keeping their income in U.S. pounds.

(These dreams will be crushed when the price of bitcoin sooner or later plunges, which is why it is important to educate people that bitcoin is not a risk-free haven. Keep bitcoin as a smaller percentage of a well-diversified financial commitment portfolio.)

As the price of bitcoin rises, even so, the value of several other tokens will rise as effectively. This will bring in far more standard citizens into the electronic financial procedure. The ecosystem will improve. Stablecoins will improve. Far more very good stuff will get designed.

(At the same time, we’ll see extra gamblers, speculators, and degens—and with any luck , the crypto industry can come across strategies to limit their behavior. At the incredibly the very least, we can established a improved example by keeping ourselves to a greater conventional.)

The picture I’m painting – the place folks go away the U.S. dollars for a trip on the crypto roller coaster – can only be probable if the uncertainty of dollars outweighs the uncertainty of crypto.

Which is what I’m saying. Faster or later, we will get off the dollar and get on to a new world currency.

What I really do not know is the timing.

When Will All This Materialize?

Once again, money crises get a while to unwind. Reserve currencies even extended.

I do not know if the U.S. will lose its dominance following thirty day period, or extended following we’re all gone. Likely in excess of the following couple of a long time.

Nor do I know that we’ll shift to a international electronic forex on this go-spherical. One more region could move in to become the new reserve currency (I’ll permit you guess which one), whilst we retain doing the job on making out the technolog

What I do know is that this future is unavoidable.

All empires drop.

All reserve currencies fade.

The concern is, what will switch the greenback?

I feel that these of us in this sector have an prospect – and, certainly, a obligation – to establish this new fiscal method in a way that is a lot more equitable and inclusive.

Those are not just buzzwords.

I believe that those of us who fully grasp this things — builders, traders, enthusiasts, all of us – ought to be pondering about how a international electronic forex can convey the maximum gain to humanity.

Not just a state.

1 of the matters that tends to make me proud to function in this market is that it’s certainly world wide. I have fulfilled so many appealing persons from so numerous nations, since we all intuitively realize that this new financial method is in everyone’s ideal desire.

It benefits anyone, not just the United States.

As we build this new world currency, making the plenty of style conclusions that will affect potential generations, permit us hold this concept firmly in our minds: we’re making a financial method that rewards every person.

Prosperity delivers peace. The more we share the prosperity, the more we share the overall health.

Revenue can’t purchase joy. But very well-built dollars can unquestionably make the situations to assistance contentment prosper.

In the coming days and months, never stress. Almost nothing improvements in our investing strategy. But hold your brain concentrated on the bigger aim: a international electronic currency, that we all served establish jointly.

(P.S. Watch my TED Converse Just one Environment, A person Income for additional on this strategy.)

50,000 crypto traders get this column delivered each and every Friday. Click on below to subscribe and be part of the tribe.