Table of Contents

TLDR: Lido’s Staked Ether (stETH) is presently investing at a 3% price cut to Ether (ETH). And the Grayscale Bitcoin Trust (GBTC) is investing at a 30% discount to bitcoin (BTC). You can invest in these now, betting that you can redeem them for complete price tag later.

Sam Bankman-Fried, the youthful billionaire with the unruly hair, manufactured substantially of his crypto fortune by buying and selling the “Kimchi high quality.”

SBF observed that bitcoin price ranges on South Korea exchanges have been somewhat increased than in other places. A savvy trader could buy bitcoin in the U.S., market it on a South Korean trade, pocket the difference, and repeat till loaded.

This method, known as arbitrage, finds the place the marketplace is inefficient, pricing the very same asset otherwise. It normally comes with more chance: in the scenario of the Kimchi premium, you experienced to rely on South Korean exchanges with your cash. But if matters work out, great fortunes can be created: just request Sam.

Presently there are two arbitrage plays offered for BTC and ETH buyers. As BTC and ETH are the two assets in our Blockchain Believers Portfolio, this is a way of getting them at a “discount,” though that price reduction will come with additional possibility.

I’ll make clear at a large amount how these investing procedures perform, and how to do them.

The stETH/ETH Arbitrage Perform

Typical viewers of our newsletter know about the prepared update to Ethereum, a.k.a. The Merge, which will migrate Ethereum from the strength-losing Evidence of Operate (PoW) to the electricity-productive Evidence of Stake (PoS). It is a major milestone in the history of crypto.

The new Ethereum will permit you to earn rewards by managing a “validator node,” but this needs 32 ETH (about $40K at today’s prices) and a whole lot of tech-savvy. Enter Lido, which pools jointly loads of lesser investors to run its individual nodes, sharing the rewards.

In other words and phrases, you can stake any amount of money of ETH with Lido, and acquire similar staking benefits as the significant players on Ethereum. This has designed Lido very popular: all-around a 3rd of all Ethereum presently staked is running through Lido.

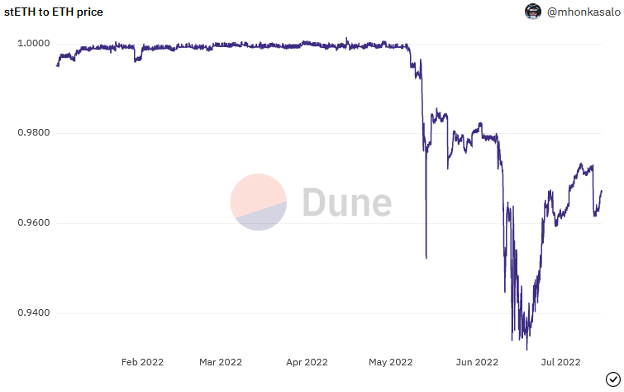

When you place your ETH into Lido, you obtain another token named Staked Ether (stETH) in return. If and when the Ethereum enhance happens, you need to be equipped to redeem stETH for ETH at a 1:1 ratio.

But at this time, you can acquire stETH at a 3% price cut to ETH, identical to the Kimchi premium. The strategy is to invest in stETH, hold out for The Merge, then redeem for ETH at comprehensive value.

For this to function, you’re earning a variety of bets:

- The Ethereum improve will actually transpire. This appears to be like probable (early exams have been prosperous), and it is at present prepared for September. But the start day has by now been pushed back several instances, and there is no ensure that it will take place at all.

- Lido will however be all-around. With the market place volatility, Lido could operate into financial trouble. This appears to be not likely, having said that, provided that Lido’s enterprise design is diverse (in truth, the arbitrage is probable because traders had so a great deal staked in Lido: deep dive here).

- The selling price of ETH (and as a result stETH) will go up. This will come down to regardless of whether you believe that the world’s premier blockchain progress platform will go on to have worth in the foreseeable future. (We do.)

The catch is that you simply cannot redeem stETH for ETH still. You can usually acquire stETH and sell it back again for stETH, of course, but the “bridge” amongst the two belongings won’t take place till right after The Merge.

How to Invest in stETH:

- Down load and install MetaMask.

- Obtain ETH and transfer to your MetaMask wallet.

- Use Curve to swap ETH for stETH (take note: enjoy the fees).

The GBTC/BTC Arbitrage Engage in

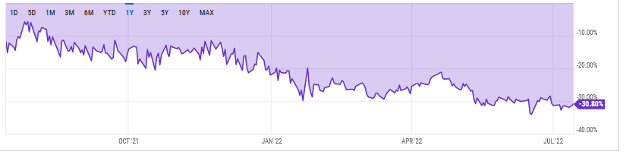

You can do a similar investment decision tactic by getting the Grayscale Bitcoin Believe in (GBTC), which is like purchasing bitcoin (BTC) at a considerable low cost (currently about 30%). But as with the past instance, there is a catch.

In a ideal globe, you could purchase GBTC and redeem it 1:1 for BTC. Having said that, the U.S. has still to approve a spot ETF, which would enable GBTC holders to redeem for the underlying BTC.

As with stETH and ETH, the prospect is to obtain GBTC now, betting that you’ll be in a position to redeem it for good BTC in the long run. (Remember, you can usually offer your GBTC back again for GBTC at the existing industry rate.)

There’s a lot more uncertainty in this article than the stETH/ETH case in point, which is possibly why it’s buying and selling at these a lower price. By getting GBTC, you are betting:

- The SEC will approve bitcoin spot ETFs. Time and once again, the SEC has rejected these programs, arguing that bitcoin doesn’t have adequate trader security. But pressure is setting up for the SEC to approve such an ETF (even the WSJ is contacting for it).

- The SEC will approve Grayscale’s location ETF. Once more, if these ETFs get approved – as they have in Europe and somewhere else – it seems probable that Grayscale, with its lengthy background in this market, would be among the those authorized. But it’s the SEC: nearly anything could transpire. (Take note that Grayscale also prices a 2% once-a-year fee, which will eat into gains.)

- The price of bitcoin will go up. You also have to feel that the world’s #1 digital asset will go on to maximize in price. Specified that it’s buying and selling at about a 3rd of its value from just previous 12 months, this also appears to be possible. But it is crypto: anything could come about.

How to Obtain GBTC:

- GBTC is out there by means of any on the web brokerage (Fidelity, TD Ameritrade, E*TRADE, etcetera.).

- Try to remember that 1000 GBTC shares = 1 BTC (i.e., multiply GBTC x 1000 to get your discounted BTC price tag).

- Hold out and see.

Opportunities are Everywhere

The investor frame of mind usually means imagining in different ways from the crowd. Now the group is supremely pessimistic on crypto, opening the door to opportunities for optimistic investors.

What I appreciate about these two options is they are turning marketplace down sides into advantages. stETH is priced at a low cost, in component, thanks to the crypto meltdown. GBTC is priced at a price reduction, thanks to the lack of regulatory approval.

An investment in these is a vote of confidence in the long run of crypto: that items will get improved.

But remember, it’s even simpler to basically purchase and keep BTC and ETH straight, ideally applying a continuous-drip month to month investment decision. You will not get the price reduction, but as the foreseeable future will get brighter, you’ll nonetheless see the advantages.

Thanks to Liam Kelly’s Decrypting DeFi column for today’s investing inspiration.