Table of Contents

In the ever-evolving world of decentralized finance (DeFi), Curve Finance, a prominent DeFi protocol, recently confirmed a devastating exploit that resulted in the loss of over $47 million. This shocking event has sent ripples across the crypto community, raising serious concerns about the security of DeFi platforms.

The Exploit: A Deep Dive

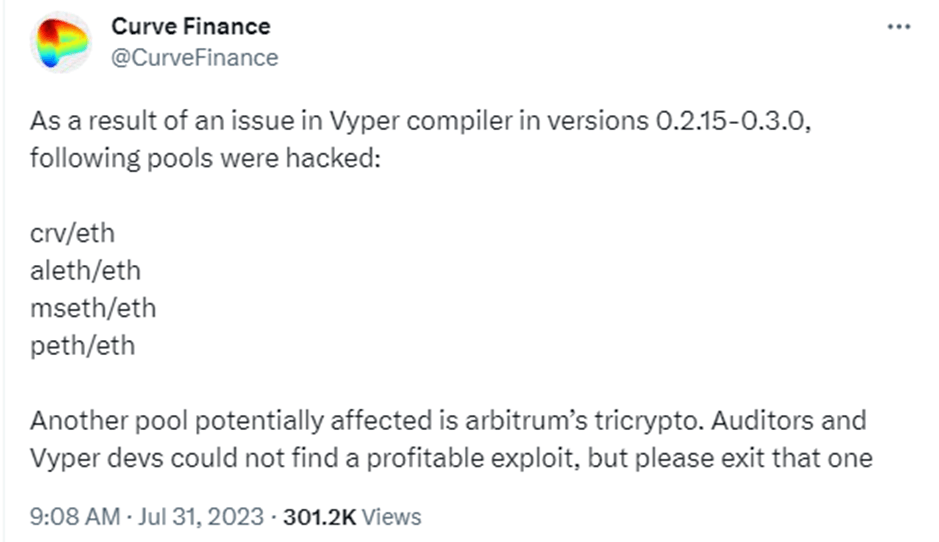

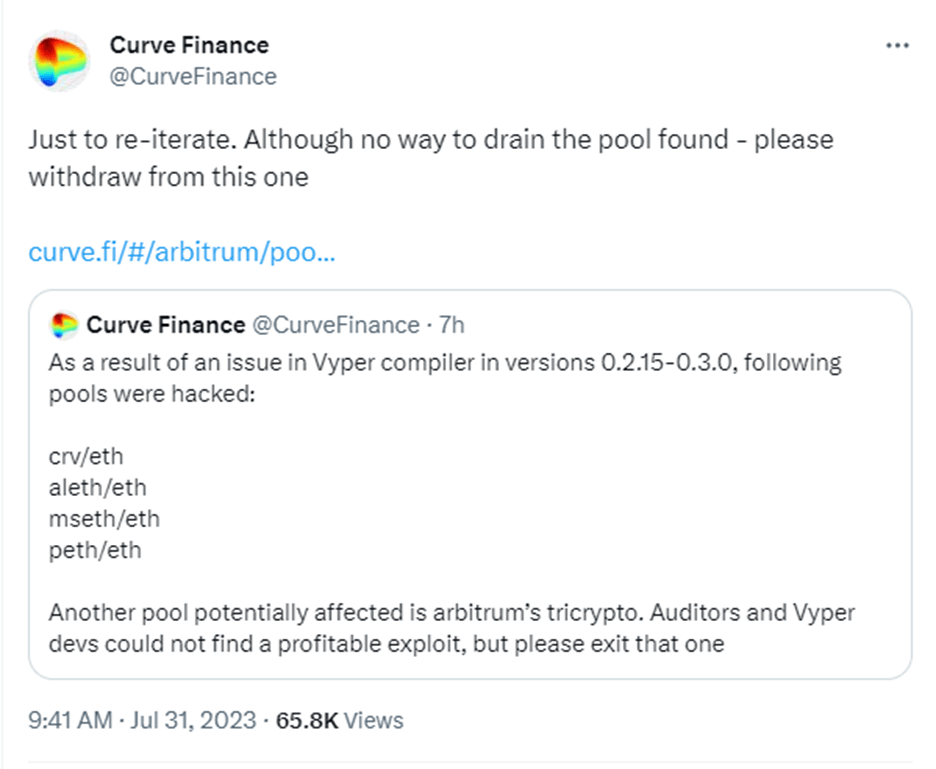

On July 30, 2023, Curve Finance’s Ethereum pools were targeted in a severe attack that exploited a reentrancy vulnerability in certain versions of the Vyper programming language. This vulnerability allowed the attackers to drain funds from multiple stable pools, wreaking havoc on the DeFi ecosystem.

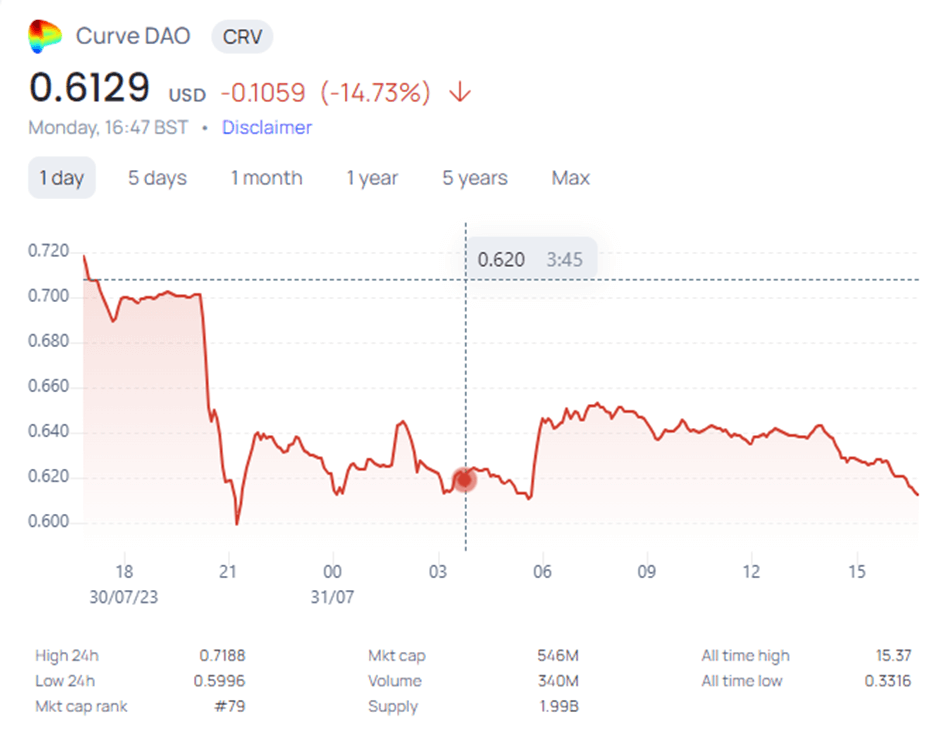

The affected pools included alETH/ETH, msETH/ETH, pETH/ETH, and CRV/ETH. The exploit resulted in the loss of 32 million CRV tokens from the swap pool, worth over $22 million. The aftermath of the attack saw the Curve DAO (CRV) token decline by over 5% in value.

The Impact: DeFi Projects Suffer

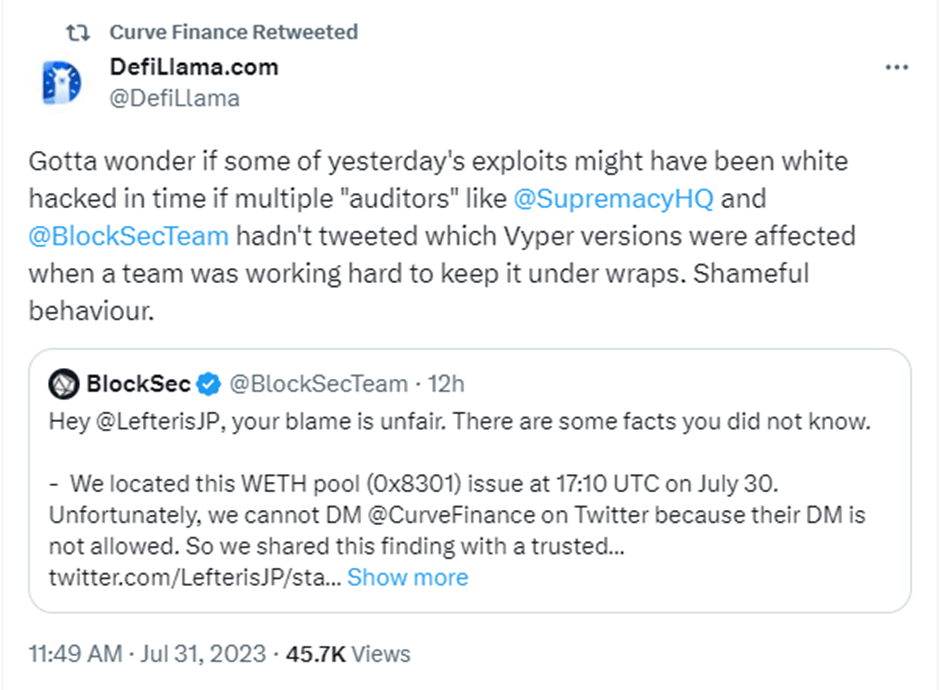

The exploit on Curve Finance’s Ethereum pools had a profound impact on several DeFi projects, highlighting the interconnected nature of the DeFi ecosystem and the potential for widespread consequences when one component is compromised. There were several occurrences that left the community astounded @DefiLlama tweeted “Gotta wonder if some of yesterday’s exploits might have been white hacked in time if multiple “auditors” like @SupremacyHQ and @BlockSecTeamhadn’t tweeted which Vyper versions were affected when a team was working hard to keep it under wraps. Shameful behaviour.

Several DeFi projects that had integrated with Curve Finance’s pools were directly affected by the exploit. Among the most severely impacted were Ellipsis, Alchemix, JPEGd, and Metronome. These projects suffered significant losses due to the drain of funds from their respective pools.Alchemix’salETH-ETH pool, for instance, lost a staggering $13.6 million. JPEGd’spETH-ETH pool wasn’t spared either, with losses amounting to $11.4 million. Metronome’s sETH-ETH pool, while not as heavily impacted, still suffered a loss of $1.6 million. These figures underscore the severity of the exploit and the significant financial damage inflicted on these projects.

The exploit had ripple effects across the broader DeFi ecosystem. The sudden drain of funds led to a sharp decrease in liquidity in the affected pools, disrupting the normal functioning of the DeFi markets. This caused temporary instability and increased volatility, affecting traders and investors who were not directly involved with the exploited pools.

Furthermore, the exploit led to a loss of confidence among some users in the security of DeFi platforms. This was reflected in the immediate aftermath of the exploit, with a noticeable increase in withdrawals from Curve Finance and other DeFi platforms as users sought to protect their assets.

Impact on CRV Token

The exploit also had a significant impact on Curve Finance’s native token, CRV. In the wake of the attack, over 32 million CRV tokens were stolen from the swap pool, leading to a sharp decline in the token’s value. The CRV token dropped by more than 5% following the news of the exploit, reflecting the market’s reaction to the incident.

The Response: Mitigation and Recovery

In the immediate aftermath of the exploit, Curve Finance and the affected projects sprang into action to mitigate the damage and initiate recovery efforts. The response was swift and multi-faceted, involving both technical and financial strategies to address the crisis.A significant part of the response was the launch of a white hat rescue operation. White hat hackers, often referred to as ethical hackers, are cybersecurity experts who use their skills to help rather than harm. In this case, they were mobilized to recover as much of the stolen funds as possible.

The white hat team worked tirelessly to trace the path of the stolen funds, identify the wallets into which they had been transferred, and attempt to retrieve them. This involved complex blockchain analysis and the use of advanced tracking tools. While it was not possible to recover all the stolen funds, the white hat operation was successful in retrieving a significant portion, thereby reducing the overall impact of the exploit.

In addition to the technical response, financial measures were also taken to offset the losses. Michael Egorov, the founder of Curve Finance, took personal responsibility for a portion of the losses. He repaid 4.63 million USDT (Tether) and deposited 16 million CRV tokens on Aave, a decentralized lending platform. This move was intended to provide some relief to the affected users and restore confidence in the platform.

Egorov’s actions were met with mixed reactions within the crypto community. While some praised his willingness to take responsibility, others raised concerns about the sustainability of such measures. Regardless of the differing opinions, Egorov’s actions underscored the seriousness of the situation and the commitment of Curve Finance to its users.

The exploit also prompted Curve Finance and other affected projects to reassess and strengthen their security protocols. This involved conducting thorough audits of their code, implementing more rigorous checks, and enhancing their monitoring systems to detect and respond to any unusual activity more quickly.

The Aftermath: Lessons Learned

The Curve Finance exploit serves as a stark reminder of the potential vulnerabilities within smart contracts and the need for robust security measures in DeFi. The incident has sparked a renewed focus on enhancing security protocols and implementing more rigorous checks to prevent such exploits in the future.

In conclusion, the Curve Finance exploit is a sobering reminder of the risks inherent in the DeFi space. As the sector continues to evolve and mature, it is crucial for projects and users alike to remain vigilant and proactive in implementing robust security practices.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.