Table of Contents

Important Investor Takeaways:

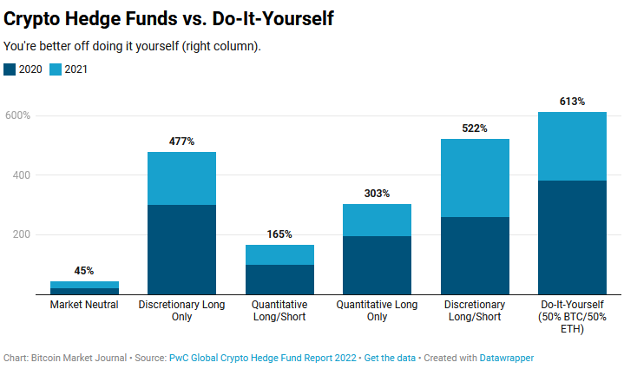

- A easy buy-and-hold system of 50% bitcoin and 50% Ethereum has outperformed the crypto hedge fund business.

- Crypto hedge cash also cost really superior costs that consume into investor earnings.

- Alternatively of choosing a crypto hedge company, buyers can established up steady-drip investing, with a 50/50 mix of BTC and ETH, and let it construct in excess of the extended time period.

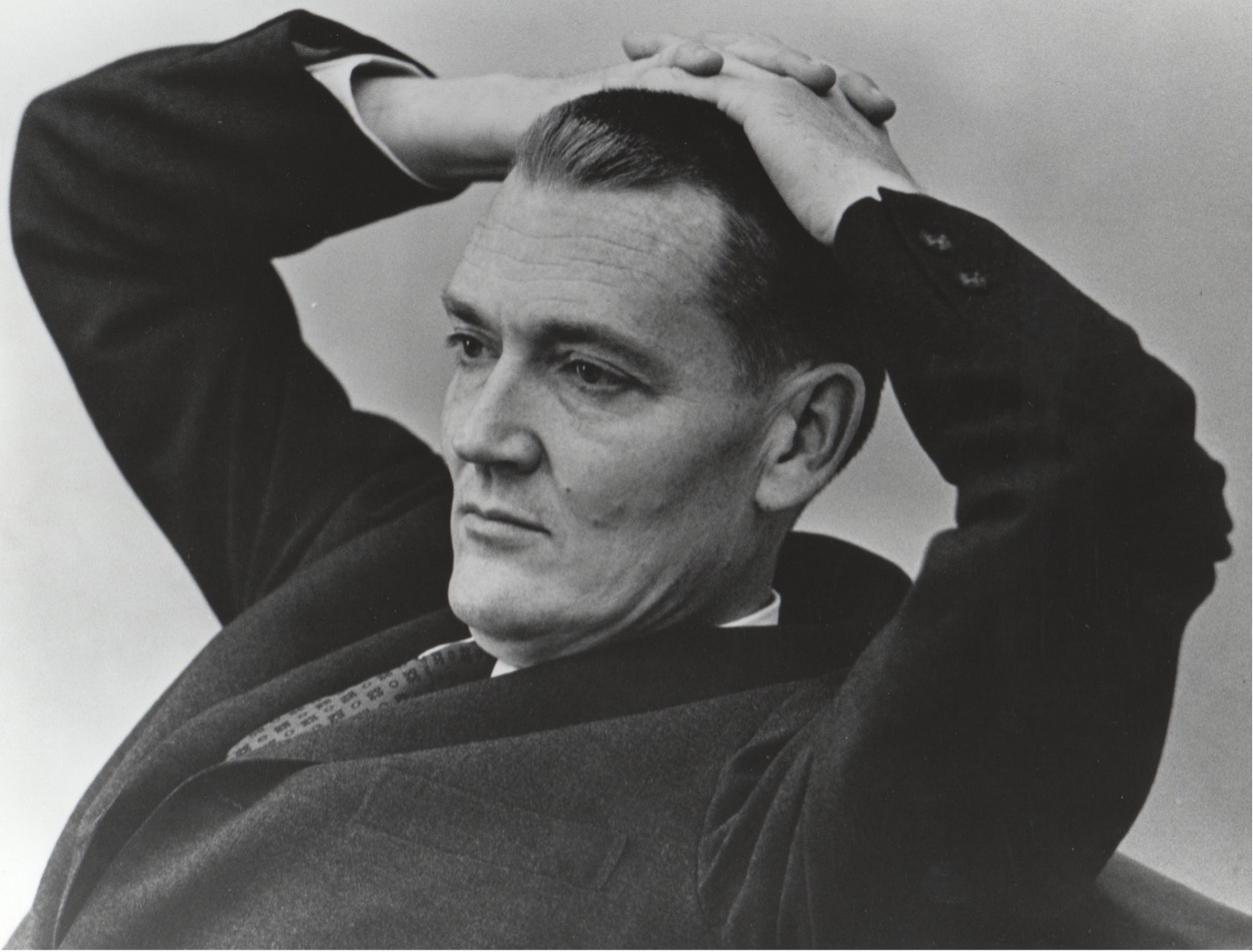

A person of my heroes is the renowned investor John Bogle, who founded Vanguard Investments, which currently has above $7 trillion in belongings. But it wasn’t usually that way.

Bogle’s critical perception was that mutual funds didn’t function for the bulk of traders. Even however they were well-known, the mutual fund marketplace did not beat the stock industry in excess of the long term. (If you’re skeptical: here’s evidence, evidence, and much more proof.)

It is continue to hard to imagine, for the reason that mutual funds are operate by clever financial pros with access to fantastic investigation. Why would so several individuals make investments in them, if they did not operate?

I’m at present reading Bogle on Investing, a 500-page selection of his essays and talks, and it is astounding how he found so a lot of approaches to arrive again to one particular straightforward strategy: most traders will do finest by investing in the in general stock sector, not by trusting the so-referred to as “experts.”

He was firmly, squarely on the facet of buyers.

This is why Bogle started Vanguard, along with its Overall Inventory Current market Index Fund (VTSAX). Investing in VTSAX is like shopping for the whole inventory market place. Considering the fact that the inventory market has averaged a 10% return more than the past 100 several years, its performance has been better than the majority of mutual cash. (Lower service fees, far too.)

It took some time for investors to realize that Bogle’s “simple” technique was correct. In crypto, we’re discovering this all about once more. But rather of mutual money, it’s crypto hedge money.

How Crypto Hedge Money Do the job

Crypto hedge funds are run by cash supervisors who pool income from traders, then place it to do the job into many crypto investments. Their intention, of class, is to make money: to outperform the “simple” Diy technique of just shopping for and keeping crypto oneself.

A new report from PricewaterhouseCoopers surveyed hundreds of crypto hedge cash, illuminating their solution inner workings:

- On typical, crypto hedge funds draw in about 30 investors, who each and every place in about $500K.

- About fifty percent of crypto hedge resources are lawfully included in the Cayman Islands, even though the administrators are located all more than the world.

- Most crypto hedge fund groups are small, just 6 or 7 men and women. I assume of them as “crypto bros long gone pro.”

These hedge resources charge outrageous fees: normally an once-a-year 2% on all your money, as well as 20% previously mentioned a particular benchmark return.

These money attractiveness to substantial web truly worth individuals (HNWIs) who just cannot or won’t buy and keep crypto by themselves. But as the report shows, the abundant are paying out dearly for placing their money into these hedge money.

You are Superior Off HODLing

While procedures range, hedge resources usually consider to make funds like traders: purchasing and offering, borrowing and lending, and yield farming. (Meanwhile, the charges on every single one of their trades is taking in into your profits, but which is one more story.)

The PwC report classifies the hedge cash by many technological names, but it really doesn’t matter because you’d be improved off holding a 50/50 mix of bitcoin and Ethereum:

A 50/50 combine, of class, is particularly the approach we use in our Blockchain Believers Portfolio, together with a healthful dose of Vanguard’s total inventory index fund.

It is so very simple that most people today really don’t believe that it functions, just like most individuals didn’t consider Jack Bogle. Absolutely the industry experts, with their enormous supercomputers and giant brains, can outperform the stock marketplace! Over the extensive operate, most of them cannot.

Their genuine final results are probably even worse. To start with, the returns over don’t account for the 2-and-20 service fees. And many crypto companies from their 2021 survey both shut up shop, or did not respond to the 2022 study (nobody likes to acknowledge very poor performance).

Real, we have only a couple of many years of data on crypto hedge money, but this is even now a really youthful business. It could be that around the future 10 several years, a few of them will do properly. But which kinds? You’re back to picking personal crypto bets, and hoping you get lucky.

It’s tempting to “trust the industry experts,” until eventually you realize the pros, as a complete, are not beating the uncomplicated do-it-your self system. Which is accurate in the inventory sector, and now we’re seeing it’s correct in the crypto markets as properly.

But there’s one far more reason to prevent crypto hedge resources: they are dangerous.

Crypto Hedge Money are Dangerous

Acquire a look at the major crypto property held by these hedge resources in April 2022 (when the study was done).

Aged like milk.

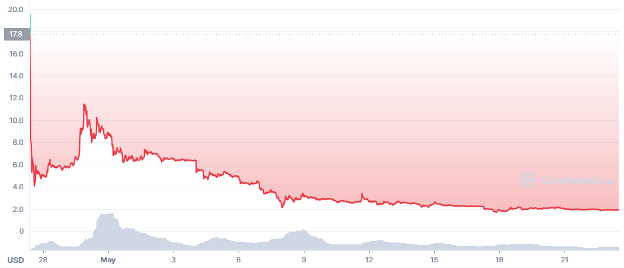

Take note the very first two property held are BTC and ETH (therefore demonstrating the hedge fund managers intuitively know the actual funds-makers), adopted by SOL (which is flirting with disaster) and LUNA (which of course famously collapsed).

When you believe in your income with a hedge fund, they’re not just going to enable it sit there. They want to do something to justify their sky-high fees, so lots of put it into LUNA (which at the time, remember, was spending 30% fascination). What could go wrong?

A good deal.

Their motivation to exhibit small-term revenue — most of them do not need prolonged-term lockups — potential customers them to just take even bigger dangers. Imagine if you entrusted your income to a crypto hedge fund, and they sunk it into LUNA. Nowadays you’d very own the sad LUNA 2.:

This is a situation the place you can make improved economical conclusions than the wealthy: just don’t employ the service of a crypto hedge fund. Alternatively, you can established up steady-drip investing, with a 50/50 mix of BTC and ETH, and enable it construct over the lengthy phrase.

The wealthy can manage to drop income. Permit them.

Straightforward Results in being Sensible

For a long time, Jack Bogle was mocked for his “simple” tactic. When he launched his initially index fund, it lifted only $11 million and was nicknamed “Bogle’s Folly.” Today the Vanguard 500 holds over $750 billion in property.

At initially, the basic system often seems too simple. A crypto hedge fund could hit a hot streak for a yr or two. A crypto staking system could provide 30% yield. When everybody else is acquiring abundant, why sit on the sidelines?

But around the very long expression, the smart cash sooner or later realizes that easier can be greater. Later in his lifestyle, Bogle warned that easy, reduced-charge index money had been rising so huge that they may be able to sway the whole stock industry.

What was after “simple” experienced come to be “sensible.”

We can see the parallel in crypto investing. People commit so considerably vitality on acquiring the following scorching token, chasing yield, or stacking DeFi procedures, that they overlook to measure their performance from just acquiring and holding a mix of 50% bitcoin, 50% Ethereum.

We Serve Buyers

The elegance of Bitcoin Market place Journal is that we really don’t accept advertising and marketing, so we have a person viewers to serve: buyers. Like Bogle, we are firmly, squarely on the side of traders.

Crypto hedge resources could also be on the facet of their investors, but keep in mind they are earning a dwelling on the 2-and-20 expenses. That will make them antsy to do things, and that stuff may possibly lead to additional chance, and absolutely potential customers to increased service fees.

Fortuitously, you don’t want an MIT-skilled Ph.D. in quantitative finance. The basic system of just shopping for and keeping 50% bitcoin and 50% Ethereum is beating the crypto hedgies.

![Local Listings For Service Businesses [E-Book] Local Listings For Service Businesses [E-Book]](https://www.rioseo.com/wp-content/uploads/2022/06/Rio_eBook_Local-Listings-for-Service-Bus_Hero.jpg)