Table of Contents

Summary: I discuss about the psychological game of investing, significantly as it applies to crypto markets. Subscribe right here and abide by me to get weekly updates.

Although it’s been a darkish calendar year for crypto, there’s an amazing silver lining: regulation is coming.

Numerous in the crypto neighborhood will disagree this is a excellent detail. They imagine regulation will stifle the field, that crypto needs to be free.

Well, we see exactly where that’s gotten us: the collapse of Terra, 3AC, FTX, and a lot of others.

There is a different narrative going all over that it is centralized exchanges that are the negative men, that only decentralized tasks can be trusted.

Besides they’re only as reliable as their code. And we’ve noticed how trustworthy that is: the record of hacks and bugs is way too lengthy to mention.

I’m nonetheless a major Blockchain Believer, but I also see the producing on the wall. The litany of crypto failures this calendar year suggest that regulation is coming. It is inevitable.

And if you can’t conquer ‘em, sign up for ‘em.

Of class, there are fantastic legislation and lousy rules, and we can only hope the guidelines regulating crypto will be superior kinds. This field has experienced 5 decades to create a highly effective lobbying drive in Washington and make important political donations, so we can hope the rules will be superior and wiser. Time, I hope, has labored in our favor.

But in general, regulation is a superior factor due to the fact we will last but not least have an understanding of the procedures of the activity. And that will make it possible for crypto to flourish.

To make clear why, enable me go back to the initially major Crypto Winter season of ’18. Basically, let’s go back to…

The ICO Summer time of 2017

Back in 2017, we weren’t naming the crypto seasons nonetheless. If we had been, we would have called it “ICO Summer months.”

Everybody was launching First Coin Offerings, which boy oh boy looked a great deal like Original Community Choices, but tied to a token alternatively of a stability.

I’m very sure this produced them unregistered securities.

But guy, it was an thrilling time. (If you weren’t there, my guide captures the spirit of this significant chapter in crypto background.)

It’s fashionable now to contact ICOs “scams,” but I read plenty of pitches from entrepreneurs who have been truly intrigued in constructing valuable solutions. There was a spirit of radical transform: decentralization was going to entirely remodel the Net, and the environment. This was a revolution!

What occurred between 2017 and 2018 — in which bitcoin lost a lot more than half its price, and the current market imploded — is harder to explain. Absolutely sure, the technologies bubble popped, but why? It wasn’t a huge collapse like the kinds we have noticed not too long ago.

It was the lawyers.

As additional individuals started out submitting ICOs, they begun using the services of legal professionals, who appeared at the Wild Westiness of it all, and cautioned these ICOs may be unregistered securities. (The SEC, much too.)

It was the uncertainty of regulation about ICOs that began the first Crypto Wintertime.

The very simple and potent takeaway is that regulations bring clarity and when there is clarity (assuming The easy trader takeaway is that guidelines bring clarity, and when there is clarity (assuming the guidelines are very good), this market will speed up past our wildest goals.

So, how do we make excellent rules? I’ll simply just explain the tough difficulty, and a recently-proposed option.

The Tricky Difficulty: Are Cryptos Securities?

I described how most ICOs have been probably unregistered securities: business owners raised revenue from buyers by offering them tokens, utilizing the income to build their crypto jobs. Buyers hoped the token selling price would go up, as the initiatives obtained extra useful.

There’s very little erroneous with this — men and women increase revenue to get started organizations all the time — other than that this was an financial investment contract, which are ruled by securities laws (and enforced, in the United States, by the SEC).

I feel the industry has been caught in this Massive Lie ever considering that: attempting to show that tokens are not securities. Very first, we transformed the title of the ICO (various situations): there was the IDO, and the IEO, etcetera., right up until we ran out of rhymes.

Then we made “governance tokens,” boasting to decentralize ownership, even however a core workforce of managers still did all the operate. This was what I’ve identified as “decentralization theater,” seeking to act like you’re not a protection. It is a lie.

At Bitcoin Current market Journal, we have held to our philosophy that tokens are like securities: we really should handle them like common inventory, and deal with the underlying initiatives like firms.

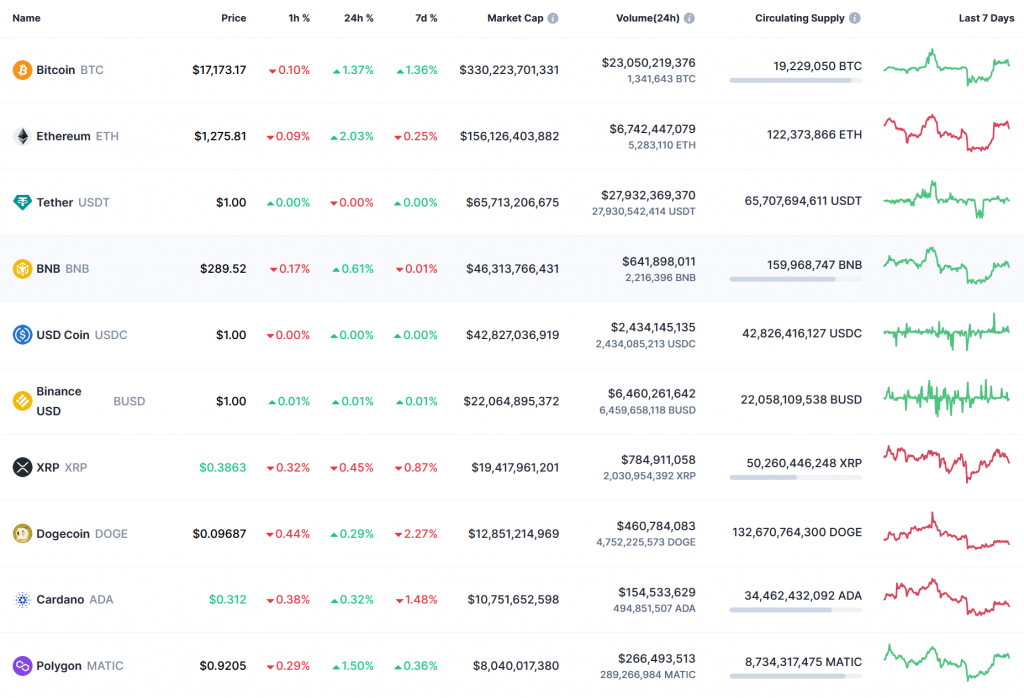

Let’s connect with a spade a spade. Everyone thinks of tokens like shares. Can we remember to just acknowledge this? The entire structure of CoinMarketCap appears to be like accurately like a stock trade:

We all buy tokens hoping “price go up,” on the initiatives of some others. That is the really definition of a safety.

BUT … there is a significant “but.”

In some means, blockchain tokens do not appear like securities. Even even though we often chat about ETH becoming like “stock” in the Ethereum “company,” Ethereum is not a company. If matters went south, whom would you sue? The stakers? The builders? Vitalik’s mothers and fathers, for conceiving him?

The SEC admits this: their posture has been that crypto tasks start out out as securities, but at some position, some of them grow to be sufficiently decentralized so they are no for a longer time securities. (Ethereum is the classic case in point.

But when specifically did Ethereum develop into decentralized ample to go from “security” to “not a security”? What was the date? What was the metric? If we simply cannot remedy this easy dilemma, we cannot get this industry to truly fly, due to the fact we however really do not realize the legislation. No a single does.

Thankfully, we now have a alternative.

The Option: Individual the Fundraising from the Token

A new paper, The Ineluctable Modality of Securities Regulation, does a masterful job of explaining why the tokens them selves are not securities. It is the fundraising agreement that is a security.

I wish all lawyers could create like this.

The paper starts with “The Parable of the Stowrange Seeds,” a fictional story about a horticulturist who develops a new fruit known as the Stowrange (rhymes with orange). She sells a great deal of Stowrange seeds to get her new fruit business off the floor (seed funds – get it?). Immediately after a while, folks are investing the seeds them selves, not to grow fruit but in hopes that “price go up.”

It is a unforgettable story, masterfully informed, mainly because it drives residence this central place: the seeds them selves are not an expenditure contract (any much more than the orange groves in the well known Howey circumstance).

In crypto, the authors argue, the initial token launch (ICO or whichever) is a securities presenting, if traders acquire the token hoping that value go up, on the attempts of some others. Simple and uncomplicated.

But soon after start, the token alone is no for a longer period a security.

You should read that sentence once more.

The authors chortle at the strategy that Ethereum could magically morph from “security” to “not a protection.” If the SEC just can’t pinpoint when that morphing comes about, they argue, it is not a workable product.

Underneath their proposed framework, the first Ethereum ICO was an financial commitment contract with the very first buyers who acquired ETH. Just after that, as soon as it was offered on secondary markets, ETH was not a stability.

This distinction offers us a path ahead. If you want to concern a new token to fund your crypto challenge, you do it like any other security. But right after that preliminary providing, most tokens would no longer be legally categorized as a stability.

If this results in being law, most tasks will in all probability airdrop their tokens for free to buyers (like Uniswap did), to get around the investment “contract.” But even that might not be a undesirable factor: at least they’d have an real product, with actual people.

The authors argue that the tokens would as a substitute be controlled as commodities less than the CFTC, and below they acknowledge that new legislation is still desired. So we’re nonetheless kicking the can down the road, but the proposal has two huge rewards:

1) clarity all around the initial providing method, and

2) a way to stop the turf wars among the SEC and CFTC.

There’s adequate crypto to share with all the regulators. And with legal clarity, there will be even more.

Why Crypto Regulation is Fantastic

To all those in crypto who are still resisting legislation: your religion is weak. If the technology is really as great as you say, won’t it nevertheless be fantastic if we actually have legal guidelines around it?

To me, it’s absolutely apparent that just as regulatory uncertainty prompted the Crypto Wintertime in 2018, regulatory certainty will usher in a new Crypto Spring.

Think about it: if all people understands the route to launching a lawful crypto undertaking, the expense bucks will arrive flooding in. Every single enterprise, bank, and economical institution will want in. It will have to be part of their method, just like the Web in the 2000s.

Even the Wild West required sheriffs. And when people felt like they could wander into a saloon with no having robbed, that’s when the advancement of the American West actually started to consider off.

The paper is a superior start off. Let us create superior laws from there. We’re prepared.