Table of Contents

What is the essential goal of blockchain technologies?

Right until now, it has generally been used to speculate on the cost of crypto tokens and generate decentralized finance protocols that let other styles of gain incentives, but is that truly all crypto can do?

A superior description of the blockchain is to create a world-wide financial system that is additional clear and economical though also currently being obtainable to everybody.

We’re not at that issue yet, but by commencing to develop more genuine-globe use situations, we can start off unlocking the genuine opportunity blockchain has for absolutely everyone.

It’s these actual-planet use scenarios that will actually profit the normal individual and pace general adoption of blockchain know-how.

To press blockchain technologies into mainstream utilization, we need to have to locate powerful ways to tokenize authentic-entire world property (RWAs). This shift from physical to electronic is an prospect that could be existence-modifying for billions of individuals all over the world.

Why We Need to have Serious-Planet Property On-Chain

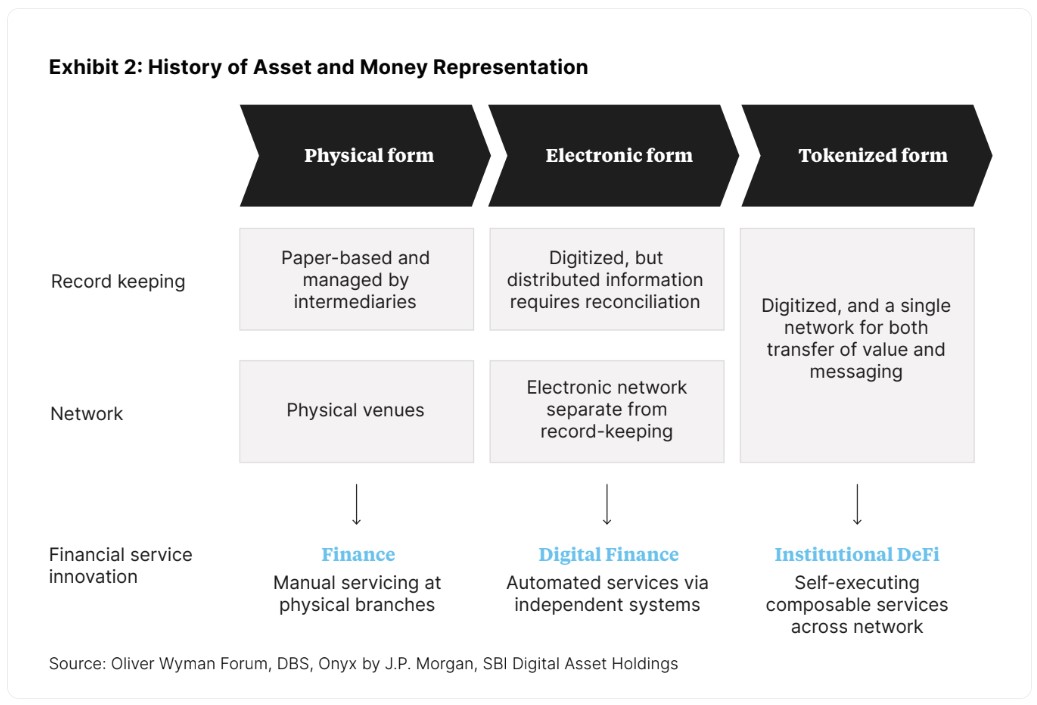

Cash makes the earth go round. Economical programs have a historical past relationship again some 5,000 many years to the Babylonian empire, exactly where clay tablets have been used to observe debts and payments.

We have arrive a extended way since then, with finance right now remaining mainly digital. On the other hand, the existing financial procedure is even now bogged down with the will need to reconcile ledgers and audit economic flows. This results in an inefficient procedure that provides charges and increases settlement moments.

A improved way is rising via decentralized finance. The upcoming move is to start out going serious-world assets on to these new blockchain rails. Tokenizing authentic-environment belongings will deliver a selection of rewards like:

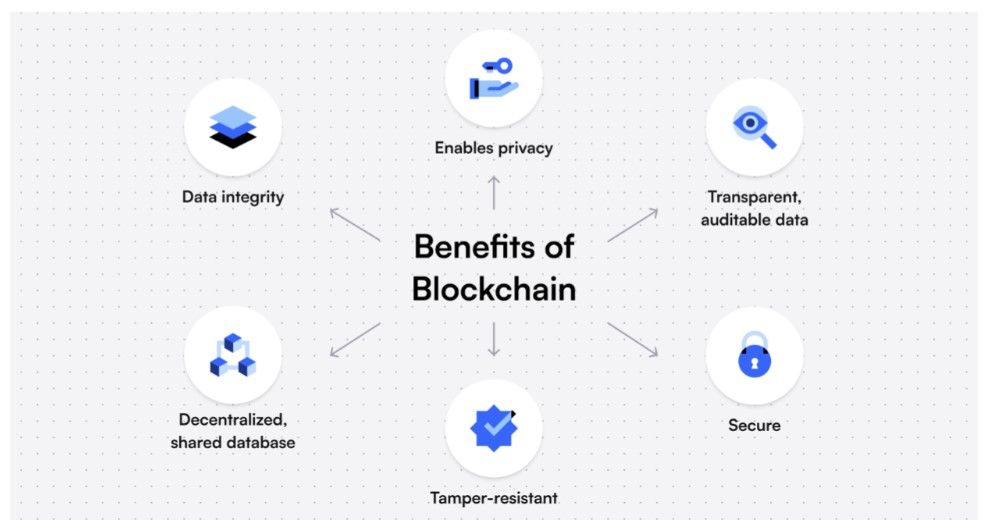

Improved efficiency: The blockchain ledger is a one source of reality, which lowers the friction inherent in current financial transactions. Atomic settlement signifies settlement comes about almost instantaneously, greatly increasing efficiency.

Decreased fees: Latest techniques are bloated with the have to have for intermediaries, which generally only provide to push up charges with out giving a excellent offer of benefit. Working with sensible contracts for several of our financial devices eradicates the need to have for third events, greatly cutting down transaction fees. For example, early tests in blockchain-based bonds have demonstrated a 90% reduction in the price tag of bond issuance and a 40% reduction in fundraising fees.

Elevated transparency: Public blockchains can be audited in actual time, opening up the capability to confirm the top quality of asset collateral and systemic chance exposure. Recordkeeping disputes are conveniently solved thanks to public dashboards that show all on-chain exercise.

Designed-in compliance: Good contracts not only have the skill to lessen the need for intermediaries. They can also be applied to guarantee compliance to regulatory oversights. This can be carried out in this sort of a way that own privateness is constantly guarded.

Liquid Marketplaces: Quite a few standard economic markets are illiquid. Feel artwork, authentic estate, even shares to some extent. Tokenizing belongings improves accessibility to trillions of bucks of mainly inaccessible property.

Innovation: When you set property and software logic on a common settlement layer, you can produce new financial merchandise, from fractionalized authentic estate funds to liquid earnings-sharing agreements. Tokenization will increase the means to construct products and solutions beforehand imagined impractical or even unachievable.

What RWAs Could Be Tokenized?

There are numerous actual-environment belongings that could probably be moved onto a blockchain for increased performance, transparency, and accessibility. Some of these are currently remaining examined on-chain:

Bodily gold: Blockchain technological innovation is now being employed to manage the possession and transfer of actual physical gold, permitting investors to keep gold securely and transparently. There are presently a number of gold-backed cryptocurrencies like Paxos Gold, but genuine digitization of gold has not been accomplished. The London Bullion Industry Affiliation has a very good examination of the present condition of gold and the blockchain for these intrigued in mastering more.

Actual estate: Land titles, deeds, and other home possession data can be recorded on a blockchain to simplify the approach of acquiring, offering, and transferring actual estate. This is 1 spot that’s been seeing a superior offer of action by now, with initiatives like Lofty.ai (household) and SliceSpace (professional) blazing the path to fractionalized actual estate possession.

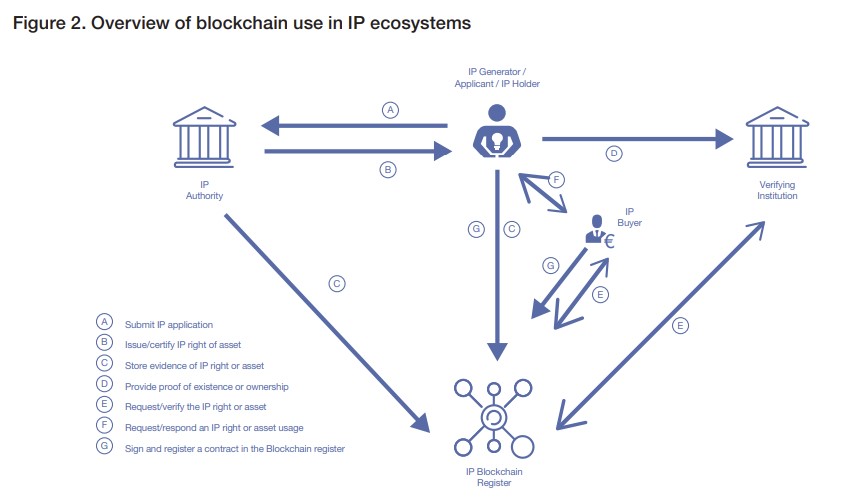

Intellectual property: Copyrights, patents, and logos can be recorded on a blockchain to make sure possession and rights are thoroughly documented and guarded. Good IP registries could keep track of the overall lifecycle of any registered IP ideal. It could also take care of the practicalities of collating, storing, and supplying these types of evidence. It would also make for smoother IP correct audits. This could simplify owing diligence routines that are essential for IP transactions, for case in point, in mergers and acquisitions. Blockchain could observe royalties for tunes streaming or articles downloads to guarantee artists get reasonable payment for their work.

Source chain management: Blockchain technological innovation can be made use of to observe the motion of products through the provide chain, enabling much better traceability and accountability for companies and shoppers.

Just one fantastic illustration is health care goods (including pharmaceuticals, clinical devices, and supplies) to ensure high-quality and avert counterfeiting. A further is agricultural items, where blockchain ledgers could permit farmers and individuals to monitor the journey of meals solutions from farm to desk.

Quite a few big businesses previously use blockchain in supply chain management which includes Amazon, Microsoft, IBM, Walmart, and Ford Motors. As adoption of blockchain engineering raises, the selection of providers applying it for their provide chains can only grow.

Identity management: Personal identity info like delivery certificates, passports, and social stability quantities can be stored on a blockchain to decrease id theft and streamline identity verification procedures. In addition, it improves info stability, minimizes prices, and makes an auditable record trail.

Blockchain identity administration can be used to a increasing variety of use scenarios throughout a selection of industries and sectors such as health care, money expert services, provide chain, World-wide-web3, and retail.

Though China’s efforts to build a national digital ID have been closely watched, there are a selection of Western companies also creating electronic ID systems like IBM and Microsoft. There are also lots of startups operating to generate digital IDs.

Financial instruments: Shares, bonds, and other economic instruments can be issued and traded on a blockchain, making a more economical and transparent financial process. We already see this in the derivatives markets, but tokenizing real stocks and bonds would considerably cut down expenses, improve efficiencies, and get rid of needless third get-togethers from fiscal marketplaces.

This location could be all set to explode quickly, with the extremely initial tradeable shares and bonds launching on the Polygon blockchain in February 2023 by way of the controlled European exchange Swarm. The trade is beginning out with Tesla and Apple, as very well as two U.S. Treasury-based mostly ETFs. Extra stocks and bonds will be added primarily based on demand from customers.

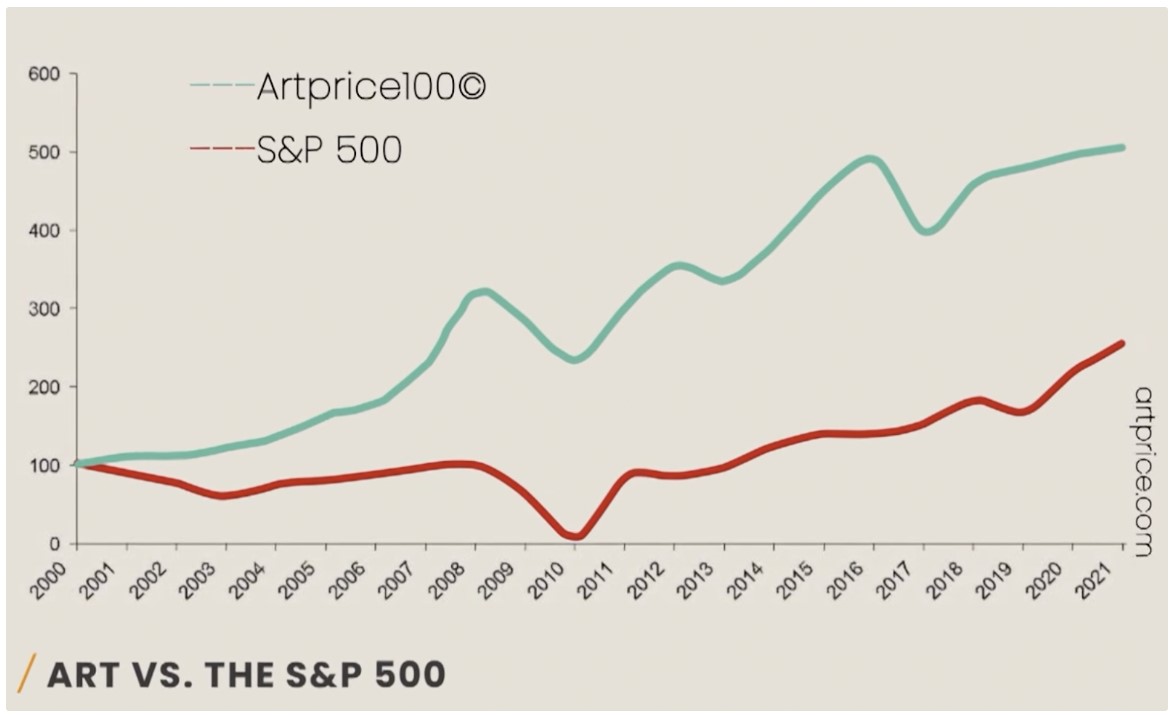

Art and collectibles: Ownership and provenance of artwork and collectibles can be recorded on a blockchain to prevent fraud and guarantee authenticity. Notice that these are not NFTs, but tokenized versions of genuine physical art and collectibles.

Tokenized artwork and collectibles also assist resolve the issue of liquidity in these marketplaces by the use of fractional ownership, which can radically maximize the investor base in the market. The digitization of artwork has started via businesses these types of as Securitize, TokenD, and Sygnum. Entry to art can enable diversify any financial investment portfolio.

Carbon credits: Carbon credits, which are applied to offset greenhouse gasoline emissions, can be tracked and traded on a blockchain to develop a additional productive and transparent market. Below the present procedure, carbon credits are (for the most component) only accessible to people with access to brokers or traders and purchased by companies. This has resulted in a fragmented, inefficient, and illiquid market.

Just one of the leaders in tokenized carbon credits is Toucan.earth, which has developed the TCO2 token. It allows any carbon credit score holder to tokenize that carbon credit rating. Toucan.earth connects holders to the Carbon Bridge, which permits entrepreneurs of carbon credits from confirmed resources to website link each individual a single to a TCO2 token. These are saved in a good contract on a blockchain databases named the Open up Weather Registry. Other carbon credit jobs searching to tokenize contain Klima DAO and SavePlanetEarth.

Insurance plan insurance policies: Insurance policy procedures can be stored on a blockchain to simplify claims processing and cut down fraud. With blockchain know-how, insurance organizations can make intelligent contracts to observe coverage claims, automate out-of-date paperwork procedures, and safeguard sensitive information.

As opposed to bodily contracts, intelligent contracts can keep track of insurance coverage statements and hold both of those get-togethers accountable. Smart contracts can also aid automate out-of-date processes, help save billions of paperwork several hours every single yr, and lower human error for the reason that all varieties and details are properly saved on-chain. Blockchain systems have previously been embraced by the classic insurance provider Nationwide and Web3 providers like Etherisc and Lemonade.

Loyalty details: Loyalty programs for merchants and support providers can be created on a blockchain, producing it less complicated for shoppers to redeem details and for enterprises to control their courses. Bitcoin Marketplace Journal is a pioneer in this house, acquiring just lately introduced its personal loyalty-primarily based token for Premium subscribers. Just one of the leaders in the blockchain loyalty details house is Bakkt, which builds loyalty plans for its customer foundation. Other significant-profile crypto loyalty plans consist of all those at Singapore Airways and Venmo.

Gaming assets: Virtual merchandise and currencies employed in on line online games can be managed and traded on a blockchain, allowing for gamers to genuinely very own their in-video game belongings. In 2021, the Blockchain Recreation Affiliation (BGA) surveyed above 200 players all over the world and found that most of them (85%) regarded asset ownership the most substantial edge of blockchain gaming. Platform online games like Axie Infinity pioneered this house, but it’s escalating substantially as leading gaming homes are developing out games primarily based on blockchain know-how.

Then, there are platforms like Enjin.io that are delivering game builders an straightforward way to increase NFT assets to their games. Sooner or later, the house could see interoperability, wherever belongings can be easily moved from one particular recreation to one more. See our guide to blockchain gaming for investors to understand additional about what is taking place in the area.

Some supplemental potential uses of blockchain technological innovation with serious-planet property include things like:

Energy investing: Power suppliers can use blockchain know-how to create a much more productive and transparent vitality buying and selling system, enabling folks and companies to trade electrical power directly with each individual other.

Drinking water legal rights: Blockchain technological know-how can be applied to track h2o rights and usage, enabling efficient allocation and distribution of h2o means.

Athletics contracts: Experienced sporting activities contracts can be recorded on a blockchain, making sure athletes and groups have accurate records of their contracts and that payments are created in accordance to agreed terms. Like other belongings, these contracts can be fractionalized and sold off by players if they want rapid liquid dollars.

Charity donations: Charitable donations can be tracked on a blockchain, guaranteeing money are employed for their meant needs and raising transparency for donors.

On line promoting: Blockchain technologies can be utilised to generate far more transparent and productive on the internet promotion devices, allowing for advertisers to monitor and validate advertisement impressions and clicks.

Authorized contracts: Lawful contracts can be saved on a blockchain, allowing parties to simply confirm the phrases of agreements and guaranteeing contracts are executed as meant.

Trader Takeaway

This list might just be scratching the floor.

In the coming 10 years, it’s possible approximately all the things of price will be put on-chain many thanks to the belief, security, transparency, and efficiencies blockchain delivers.

Tokenization of genuine-planet belongings has one particular enormous advantage: accessibility. If you have been fascinated in investing in art, carbon credits, or even shares, and you have discovered there are way too a lot of hurdles, tokenization of these assets can support get over lots of of them by way of amplified liquidity and simplicity.

If you’re an trader, this is an exciting time. In our look at, asset tokenization will only proceed to expand, and people who comprehend the benefits at the start off are most likely to reap the benefits.