Table of Contents

Summary: I communicate about the psychological activity of investing, notably as it applies to crypto marketplaces. Subscribe here and stick to me to get weekly updates.

https://www.youtube.com/observe?v=UKCmefQdplI

Very last calendar year, I noticed a Netflix documentary that I have been recommending to absolutely everyone. It virtually changed my daily life. (Enjoy the trailer right here.)

Stutz is a documentary by the actor Jonah Hill, about his psychotherapist Phil Stutz, who is sort of a legend in Southern California. Actors, revenue managers, Fortune 500 CEOs all go to Stutz, mainly because he’s produced a method that operates for people today achieving the best amount of good results.

This procedure operates for buyers, also.

The program, which Stutz phone calls “The Tools,” is a series of psychological visualizations, accompanied by a experience. You observe these applications during the day, any time you want them.

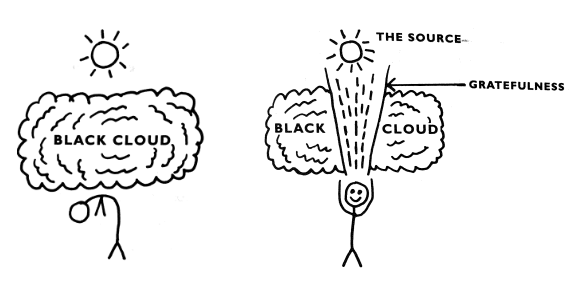

For case in point, a single device is referred to as “Grateful Stream.” Every time you really feel fret or panic, you basically close your eyes, checklist a few matters you are grateful for, then maintain your intellect in the open “flow” of gratefulness. (Full instructions listed here.)

The documentary does a great task describing these resources, together with hand-drawn illustrations from Stutz, to support you visualize the visualizations:

Stutz suffers from Parkinson’s and other neurogenerative disorders, which gives the black-and-white documentary a form of sweet pathos. This is not a Tony Robbins-fashion self-aid guru barking at you about peak general performance: this is a wounded healer.

In truth, considerably of the documentary is about embracing the imperfect areas of ourselves – what Stutz calls “The Shadow” – that we never want the world to see. When Jonah Hill decides to embrace his possess shadow in the movie, it is a brave and unforgettable moment.

You know, Perfectly, he just did that, and he’s even now alive. Maybe it’s alright for me to do that, also.

For the past number of months, I’ve fallen down the Phil Stutz rabbit hole. With his co-writer Barry Michels, he’s authored two publications: The Applications and Coming Alive. They’ve got a podcast. He’s been a visitor on other podcasts, from Marc Maron to Goop. The New Yorker did a element story on him.

Most importantly, I’ve finished the physical exercises. Rigorously. Each and every day. I have my Fitbit set to buzz me when I have been sitting on my ass too extended, and I use those people random reminders to exercise The Instruments.

They function. And they function, precisely, for investors. Here’s why.

Conquering Your Thoughts

The greatest obstacle we have as traders is our own minds.

No subject how rational you feel you are, it’s tricky to acquire when the market place is down, when absolutely everyone is moping about “crypto wintertime.”

And it is just as really hard to steer clear of acquiring when the market place is up, when the price of bitcoin (or no matter what) is soaring to new heights.

It is really hard for me, as well.

This is the opposite of how good benefit buyers work: they obtain when stocks are “on sale” (i.e., when the current market is down). And if they offer, it’s when the stock is “overvalued” (i.e., when the sector is up).

The Tools can be employed to rewire this self-defeating mental actions, by operating with the thoughts that drive us to make undesirable investing decisions.

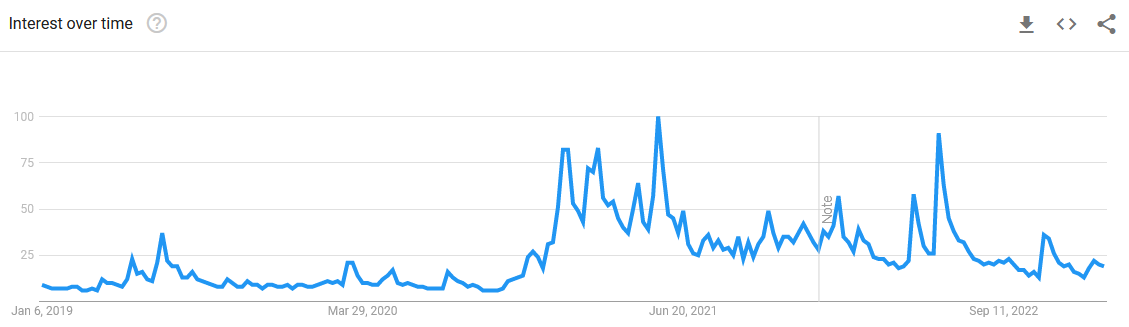

Emotions drive trader conduct, especially in crypto. As I’ve said a thousand periods, just view Google lookups for the word “bitcoin,” which spike every time bitcoin spikes. When the cost goes up, quickly everybody is interested.

The classic inner thoughts are concern and greed. But search much more intently, and there is a limited knot of emotions below these two large boys. Possibilities are, these feelings dictate many of the existence selections you make – not just the investing selections.

Concern, for example, comes in lots of different flavors:

- Dread of missing out

- Dread of on the lookout foolish

- Panic of getting rid of revenue/stability

- Fear of losing standing/standing

- Anxiety of the unidentified

So several fears. But we can not be scared to perform with these fears.

https://www.youtube.com/observe?v=kWZaQgDeHYM

In an additional 1 of The Equipment referred to as Reversal of Drive, you visualize:

1) You and your Shadow plunging headlong into a black cloud of these fears, like charging into a fight, shouting, “WE Enjoy Dread!”

2) Amid that chaos and irritation, the two of you shout, “BRING IT ON!”

3) Finally the black cloud propels you forward into crystal clear white gentle, serene and tranquil. You shout, “FEAR SETS US Totally free!” and sit for a minute, generating a mindful effort and hard work to ratel the bliss.

These Applications must be practiced above and more than all over again, like a musician working towards scales, or an athlete working drills. After or 2 times does not slash it: you have to practice your thoughts like you are in a marathon.

As you get extra proficient at follow, you also get greater at pinpointing the “cues.” These are the emotions, mostly unconscious, that signal us it’s time to observe. The a lot more we practice these tools, the far more we see when we will need to observe them: when the emotions arise.

These emotions can be the investor’s mortal enemy – but they can also develop into our very best mate. Here’s how it’s happening for me.

My Own Tale

At a modern business conference, we did a StrengthsFinder evaluation for all our workforce, and my most important toughness was an “Achiever.” You can study all about me in this article, in particular my “constant require for attainment.”

Frankly, it’s exhausting.

This relentless ambition drives just about every moment of my waking day. I am an overachieving workaholic that wishes – no, requires – to depart his mark on the globe. My finest concern is that I die with no fulfilling my entire potential.

(My Shadow – the component of me I really do not want you to see – is the unfortunate-sack man who the moment bought fired from a occupation. There he is, standing outside his previous workplace, holding a box complete of his stuff, putting on an overcoat that’s one sizing far too big.)

Yesterday, I’m strolling by downtown Boston, and commonly my mind is restlessly comparing my achievements to every person else’s. “That corporation just moved into that sweet business office place, why isn’t your organization there but?” It is not an obsession, just a small drone of dissatisfaction, like a delicate toothache.

But yesterday I seen one thing refined and profound: the voice was tranquil.

It was an remarkable relief. I could not place my finger on why I felt so great, but I understood it was connected to the interior get the job done with the Resources. Later, with some time to mirror, I realized it is not that the ambition or achievement are diminished it is that the self-vital voice discovered to shut up.

“I just adore how these tools make me experience,” claims Jonah Hill in close proximity to the stop of Stutz. “And I want to share them with the globe.”

I get it now.

Target on the Procedure, Not the Success

A single of Phil Stutz’s massive mantras is to “focus on the process, not the outcomes.”

This viewpoint is not organic for us, simply because our culture is all about effects. It’s about how a great deal excess weight you missing, your fourth-quarter gross sales, your crypto internet worthy of. We just want to see the base line, the last amount. The outcomes.

But the process is how you get to the effects.

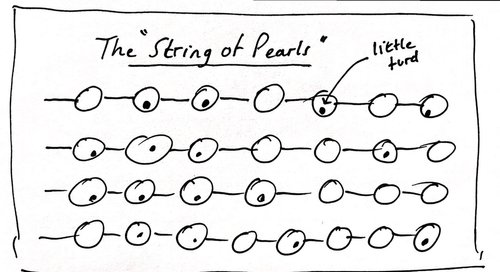

Stutz takes advantage of the analogy of a “String of Pearls” (a further tool), exactly where each working day you get up and do the following ideal factor. Then the subsequent ideal thing, and the following. Just about every ideal motion — each beneficial habit — is like stringing pearls onto a necklace.

The catch is that every pearl has a tiny turd within. In other words, each motion will truly feel imperfect. It will not really feel natural. It will really feel uninteresting, or pointless, or silly. We want benefits now.

If you do the appropriate things – like continuous-drip investing – it will occur bit by little bit, but excruciatingly slowly but surely. Days, months, a long time will go by. You will assume to by yourself several situations, “Why am I undertaking this all over again?”

But if you continue to keep accomplishing the proper issues, all over again and yet again, there will come a day wherever you glimpse back and it is like the outcomes just sprang into staying. They snuck up on you. Truth altered when you weren’t seeking.

The crypto portfolio has all of a sudden develop into a at ease nest egg that will enable you retire early. Your system is abruptly in the very best shape of your life. Or you wander down the street and know that you have a newfound internal peace.

Of course we care about the effects. It is that our principal concentration is not on the outcomes, but on no matter if we are committing entirely to the method: are we performing the ideal points, every working day? Are we stringing pearls on the necklace?

If so, terrific things will materialize.

Stutz is obtainable on Netflix listed here. Cheat sheet for The Tools obtainable listed here.

50,000 crypto traders get this column every single Friday. Simply click in this article to subscribe and join the tribe.