Table of Contents

Summary: I converse about the psychological video game of investing, specially as it applies to crypto marketplaces. Subscribe below and observe me to get weekly updates.

The crypto sector is dwelling a lie.

Most tokens genuinely are securities.

The crypto field desires you to consider that most tokens actually are not securities. This is the Wonderful Lie.

Nowadays I will reveal how (and why) this Terrific Lie took keep, and how we usher in a new age of crypto honesty. By the end, I hope you will see the Fantastic Lie is basic and apparent, and how you can support us shift toward honesty. (It will take two minutes.)

Why Most Tokens are Securities

If you’re just becoming a member of us, the problem of no matter if or not tokens are securities is at the heart of the crypto marketplace. Almost everything revolves close to it.

For simplicity, feel of a security like a firm inventory: like getting APPL inventory to commit in Apple. Organizations difficulty these shares of inventory to raise funds, then they use the revenue to increase their enterprises.

Definitely, this is specifically what happens in crypto: a few of whiz youngsters get an idea for a new products, they generate a new token and offer it to buyers, then stay off the income even though they create the merchandise into a little something excellent (or not).

This is so evident that I should not even have to say it: most crypto business people market tokens to traders to fund a business enterprise.

It may possibly not be a company in the regular sense (i.e., there might be no corporation), but the mechanics are the exact same.

Market tokens. Elevate cash. Build the enterprise.

There is almost nothing morally wrong with this. As very long as the intentions are fantastic (and most of the entrepreneurs I’ve achieved have fantastic intentions), this creates value for the environment, in the variety of new products or products and services. In The united states, we applaud modest business proprietors.

But legally, it’s one more matter. Securities, of class, are ruled by the SEC, the company charged with defending traders (which, to be reasonable, is an not possible endeavor, given that a lot of buyers really do not want to be shielded).

Making a little organization is simple. But elevating revenue from traders, beneath the present laws, is hard. Truly really hard.

To elevate money from the common community in an Original Community Providing can charge around $100 million: it’s a non-starter for startups. There are other automobiles like Regulation A that can allow for entrepreneurs to elevate lesser amounts, but they are continue to complicated and high-priced.

The reality is that you have to raise cash just to elevate cash.

This generates a Catch-22: you have to have a particular volume of funds just to retain the services of the legal crew and file the providing, then extra cash do all the marketing and advertising and advertising of your Reg A presenting. In the meantime, you are striving to build a products, come across the marketplace match, and make the small business?

For most entrepreneurs, this technique does not get the job done.

So when blockchain-primarily based tokens came along, it was a revelation. In this article was a way to rapidly elevate revenue, so you could have some run area to build a merchandise and see if it worked.

Not like the legal route, generating tokens was just a couple strains of code. Crypto created it straightforward to obtain the funds from traders, and start off putting it to work. This is what fueled the ICO growth of 2017, and each blockchain growth considering the fact that then.

The difficulty is that beneath present legislation, most “tokens” are really “unregistered securities.”

This is what the SEC’s Gary Gensler has claimed, but the crypto field does not like it. So the industry has centered its appreciable brainpower into finding techniques to make tokens not securities … and so started the Fantastic Lie.

“Most” Does Not Imply “All”

When we say “most tokens are securities,” make sure you remember that “most” does not imply “all.”

This is where the SEC is falling down.

To be very clear: some tokens are legitimately not securities. Our BMJ Reward Token, for example, is not made use of to increase money — it is a loyalty token for our Top quality subscribers, like any other reward software.

Also, it’s hard to argue that the new coffee collectibles from Starbucks are securities, or the new NFT avatars on Reddit. These tokens push company, but they are not securities. Large change.

But if you’ve raised cash to build a organization, passing all four prongs of the Howey Check, then you’ve offered an unregistered stability. To argue otherwise is the Terrific Lie.

The latest variety of the Great Lie is “decentralized governance tokens”: the imagining is that if crypto tasks are owned and managed by the individuals, no a person is legally liable. The SEC has no 1 to sue.

As I have claimed frequently, this is an experiment doomed to failure. The natural beauty of terrific businesses is they are operate by great managers and leaders. (Can you envision if the general public ran Apple?)

Crypto projects are exploring that “decentralized governance tokens” are a mess, considering that most tokenholders are a) as well busy to get involved and/or b) really do not have the complex knowledge to make significant contributions.

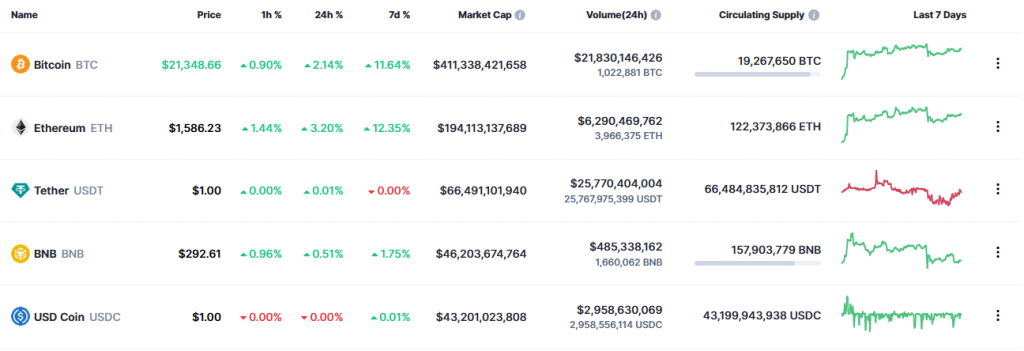

There are a lot of other types of the Wonderful Lie, commonly rhyming with “IPO.” (ICO, IDO, IEO, etc.) But they all contain elevating income, having a token that features like a share of inventory, and seeing the price on tickers that glimpse precisely like a inventory trade:

A path towards crypto honesty commences with 3 concepts:

- Most tokens are unregistered securities

- To keep away from securities law

- For the reason that these laws really do not operate.

Why Securities Regulations Really don’t Do the job

I just watched the 4-section Netflix sequence MADOFF: The Monster of Wall Road about Bernie Madoff’s Ponzi scheme that defrauded traders out of $65 billion. The documentary goes into depth about the SEC’s failure to find the fraud, even when they had been alerted to it numerous moments.

The legislation that have been supposed to defend traders from Bernie Madoff? The guidelines really do not get the job done.

The united states was established on the rules of difficult function and entrepreneurship: the “pioneer spirit.” But securities guidelines, as we have just lined, make fundraising impractical for most business owners and pioneers. The guidelines do not perform.

The SEC will say that the securities laws, most of which were being created in the 1930s, have served us pretty perfectly. But there have been loads of updates to the initial regulations because then, because, very well, the rules don’t get the job done.

The legal guidelines them selves are not created by the SEC the laws are written by Congress. (The SEC just enforces them.) To get superior legislation, we need to have motion from Congress.

Superior regulations will enable entrepreneurs and startups to elevate money by issuing tokens to the community – perhaps up to a modest restrict (say, $100,000). They can then use these tokens to bootstrap the network, and construct some thing valuable or excellent.

What is incorrect with that?

What the folks want is the capability to use tokens for fundraising. That is the huge, apparent, elephant in the place. I believe we can do this, and safeguard investors at the identical time.

The legal guidelines don’t do the job: they are unnecessarily restrictive and prohibitively highly-priced for small corporations and entrepreneurs to adhere to. Just glance at the explosion of token-based mostly assignments considering that 2017: that should really be all the proof you want.

Folks want to build firms, to develop firms. There is an monumental untapped likely of little business enterprise creative imagination and entrepreneurial expertise. Superior guidelines will necessarily mean an explosion of incredible people setting up valuable goods and companies, developing jobs and wealth for the next era.

Ideal now, that explosion is bottled up inside archaic securities rules.

The superior news is, rules are human innovations, and individuals can modify them. Rather than twisting ourselves about the Terrific Lie, let’s do one thing radical: let’s start out telling the fact.

If you’re a U.S. citizen, compose your Senator. You can copy and paste this type letter:

Dear Senator [NAME],

Our recent securities legal guidelines do not get the job done.

As a crypto trader, I urge you to do the job with your fellow Senators to locate better laws to govern electronic belongings, so that trustworthy buyers like myself do not come to feel like criminals for investing in bitcoin, Ethereum, and other tokens.

I believe that in the electric power of these systems to transform the entire world, and I feel the U.S. ought to lead the planet in finding a way to guard traders when encouraging crypto to prosper. The two are achievable.

Remember to function on creating better securities regulations that let crypto entrepreneurs to innovate, even though making it possible for crypto investors to participate.

Sincerely,

[YOUR NAME HERE]

Let’s be genuine: this is what we seriously want. Let’s just appear out and say it.

The worst they can say is no. But the very best they can say is Yes.

50,000 crypto investors get this column just about every Friday. Click below to subscribe and sign up for the tribe.